Good morning, Investors!

Later this morning I’ll be recording my usual post-F.O.M.C. thoughts with The Prospector News Podcast’s Mike Fox. You’ll get those, most likely, Saturday a.m. once he has them posted.

For present purposes, a major contradiction lurked within the central bank’s stance announced yesterday; at least that’s how it appeared to some, including one reporter who directly questioned Fire Marshall Jay on this.

As I surmised would be the case on Your Money Today a few days back, the consensus did remain for two 25-bps rate cuts in 2025 despite the recent weaker economy and market shakiness.

Indeed, the so-called “dot plot” was even firmer on that outlook than in January.

But this came even as the Fed significantly bumped back HIGHER its inflation forecast: from 2.5% to 2.8% on Core CPI for 2025.

And this came as the Fed reduced its remaining QT, or Quantitative Tightening. It will now allow only a net $5 billion in Treasuries to come off its balance sheet per month, down from $25 billion.

AND it comes as Powell opined that President Trump’s tariff policies will exert upward pressure on inflation…but that yet he doesn’t plan to react to that.

Did the Fed tacitly run up the white flag on its seemingly doomed 2% target for inflation and set the table to tolerate and even further enable higher inflation going forward…and with all that will bring with it?

Stay tuned…

_____________________________

Yesterday, I sat down with my friend Deepak Varshney, for yesterday’s purposes to give a deeper dive into Formation Metals, Inc. (CSE-FOMO; OTC-FOMTF.)

You can watch our discussion RIGHT HERE or by clicking the graphic below…and when you do, you’ll see why FOMO shares (which we started with last fall via that company’s spinout from Usha Resources) have more than tripled since being listed on the CSE in October.

C.E.O. Varshney succinctly lays out the story behind the company acquiring the N2 Project in Quebec’s Abitibi-Greenstone Belt; one with substantial work already done and likewise great upside potential.

But more than that one specific project, this is a story of people who know how to get things done.

On that score, pay special attention to my own anecdote/experience at the recent B.M.O. Conference here in south Florida, where key FOMO Advisor and “insider” shareholder Jonathan Deluce (also the C.E.O. OF Abitibi Metals, as you already know) was uniquely conspicuous there!

Formation Metals, of course, remains a speculative BUY.

_____________________________

Moving on, I’m adding a new recommendation today to my list of speculative story stocks; a company and theme I was presented with several weeks ago.

While at a different conference in Miami, a long-time friend, colleague and fellow investment-oriented publisher called me to discuss the theme of quantum computing; something that’s been in the news a lot.

And indeed, as has been the case with other significant advances in computing/data keeping and related technologies over the years, current trends to supercharge computing abilities much more are already having positive impacts on our lives, productivity and more.

And one by one, major tech companies have been coming out with announcements of new collaborations…new quantum computing “super chips” and processers and the like.

But my friend hadn’t urgently contacted me to tell me about the good aspects of the quantum race.

Indeed, the story he laid out was of one of the major consequences of these advancements: the similarly augmented ability of bad actors, rogue states and even for-profit troublemakers to be able to steal your data.

That’s something that already happens constantly; we see it in the news all the time. It’s an unfortunate and often devastating major drain on all our time, economies, data and more.

Among other things it has introduced the term “ransomware” to our vocabularies and made us properly wary of clicking on ANY unsolicited text or email we get daily.

And as I’ve learned even more over the last several weeks about this threat–one already costing trillions of dollars’ worth of losses to the global economy–I couldn’t help but hearken back to another time when a major, looming disaster seemed poised to throw us all for a loop.

The Y2K Computer Crisis of a quarter century (DAMN, time flies!!) ago.

As I’m sure you remember, the then-ancient computing world had what seemed a fatal flaw. Using just two digits in coding for the year we were in, what would happen when we went from ’99 to ’00?

Many billions of dollars were spent on fixing this legitimate (albeit, at times, wildly exaggerated by some) threat. We took then-heavy positions in a few individual software and related companies and even one hot mutual fund at the time focusing on solving the Y2K Problem; and did so well that 1999 ended up being one of the two years in The National Investor’s history that we enjoyed a triple-digit overall portfolio return for the year.

Fast forward to today.

While the average consumer and investor have all heard of various “ransomware” attacks and the like, there is FAR from the widespread awareness today of the more open-ended “Y2Q” threat as I’m calling it compared to when we are incessantly hit with the “Y2K” issue in the 1998-199 time frame.

And that means a lot of things as I’ll be writing/presenting in the coming days; not the least of which is an opportunity for investors to take positions in some of the best “plays” to counteract “The Quantum Menace.”

NEW RECOMMENDATION —

Scope Technologies Corp. (CSE-SCPE; OTCQB-SCPCF)

At this morning’s open — C$0.67/share, or US$0.47/share

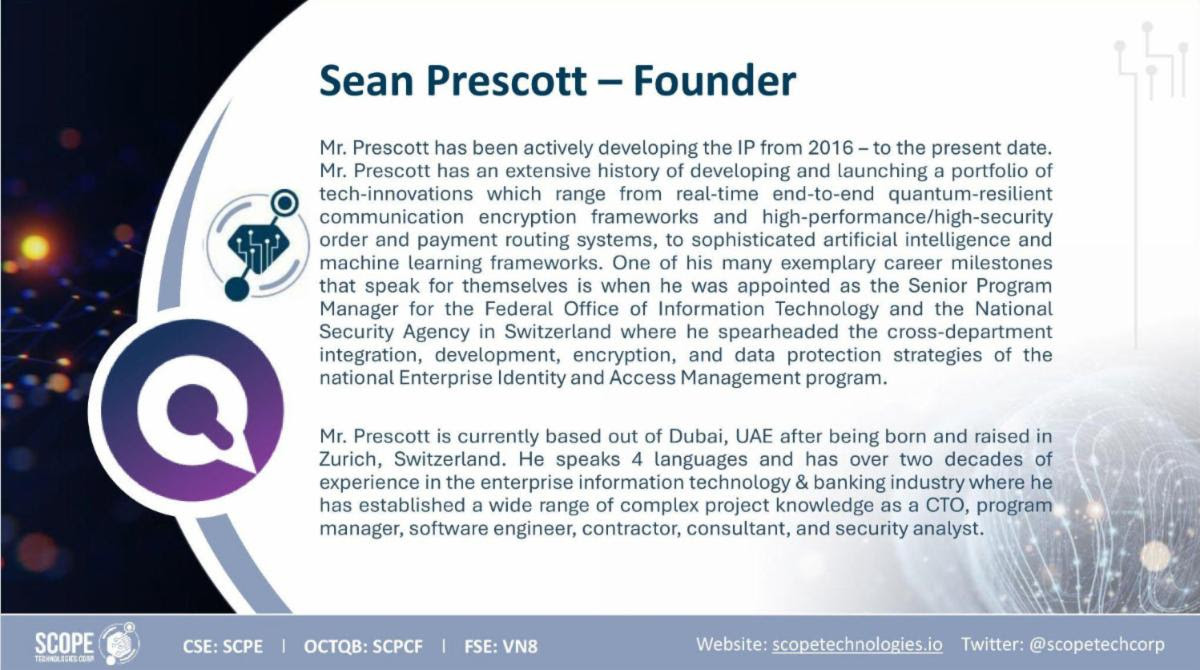

You’ll be hearing a lot about Scope in the coming days, including via coming interviews with the C.E.O. James Young (who I have visited with a couple times of late, including yesterday) and Founder/Chief Technology Officer Sean Prescott, whose high-level skills and experience at, among other places, his native Switzerland’s National Security Agency are the foundation of Scope’s wares.

I’ll have more color/detail on Scope to follow in a couple forms; but for now, I want to generally point out that this company’s part of the equation to protect customers from having data, etc. invaded by bad actors is actually remarkably simple, straightforward and cost effective.

Scope is not a full blown “cyber security” company. Instead, as C.E.O. Young described it to me, his company’s efforts instead are akin to “reinforcing padlocks.”

Scope focuses very specifically on two key areas:

First, they reinforce weak points in existing protocols. Imagine that you have remodeled your home and have already gone to the time and expense of making it not only look nice, but having it secure. Trouble is, at the back door the actual lock and security on an otherwise nice, stout door is suspect.

Scope’s technology provides arguably the most advanced modern “lock.” Their lock on the door can keep you safer.

Secondly, Scope provides a decentralized and encrypted “copy” of your “house.” So in addition to its cutting-edge technology to provide customers with the most advanced and hard-to-invade “firewall,” it provides a backup similarly, essentially impregnable where an exact copy of all your data is securely stored.

So in the event a bad actor somehow gains entry, makes off with the contents of your “house” and demands ransom, you can tell that bad actor to go pound salt. You still HAVE all your data.

Now, as was the case with the many companies claiming to have “fixes” or “patches” back in the Y2K years, there are many today that are attacking what is a more insidious and open-ended (there’s no date certain when it will go away, as was the case on January 1, 2000!) “Y2Q” threat. I’ll be adding one or two more, frankly, who have different niches than Scope and where I think that they have a leg up.

But as for the first time in a while I get more engaged with a breaking technology theme, I’m starting with Scope today due to its greater ease of entry into this field for its wares than in most stories. And as the company has reported twice in just the last week (see HERE) they are moving quickly into collaborations to sell their wares more in Asia, Europe and North America alike.

Make sure to spend some time at Scope’s page for now (the home page is RIGHT HERE) to learn even more.

And ahead of my own visits with management to come, I’ll in closing commend to you THIS INTERVIEW that both Young and Prescott gave late last year to Why the Buzz? — a podcast produced by investment adviser portal Advisorpedia.

You’ll learn a lot, as I did!

All the best,

Chris Temple

Editor/Publisher

Thursday a.m., March 20, 2025

Don’t forget that you can follow my thoughts, focus and all pretty much daily ! ! !

* On Twitter, at https://twitter.com/NatInvestor

* On Facebook at https://www.facebook.com/TheNationalInvestor

* On Linked In at https://www.linkedin.com/in/chris-temple-1a482020/

* On my You Tube channel, at https://www.youtube.com/c/ChrisTemple (MAKE SURE TO SUBSCRIBE!)

When you join me, among the many things you’ll be entitled to is my “Members Handbook.” It crystallizes my approach to the markets…asset allocation recommendations… how I select individual companies…and a LOT more.