Greetings Investors! There's a LOT of subjects and "meat' for you this weekend... Plurilock Security, movement from the Fed, and more... so let's get right to it!

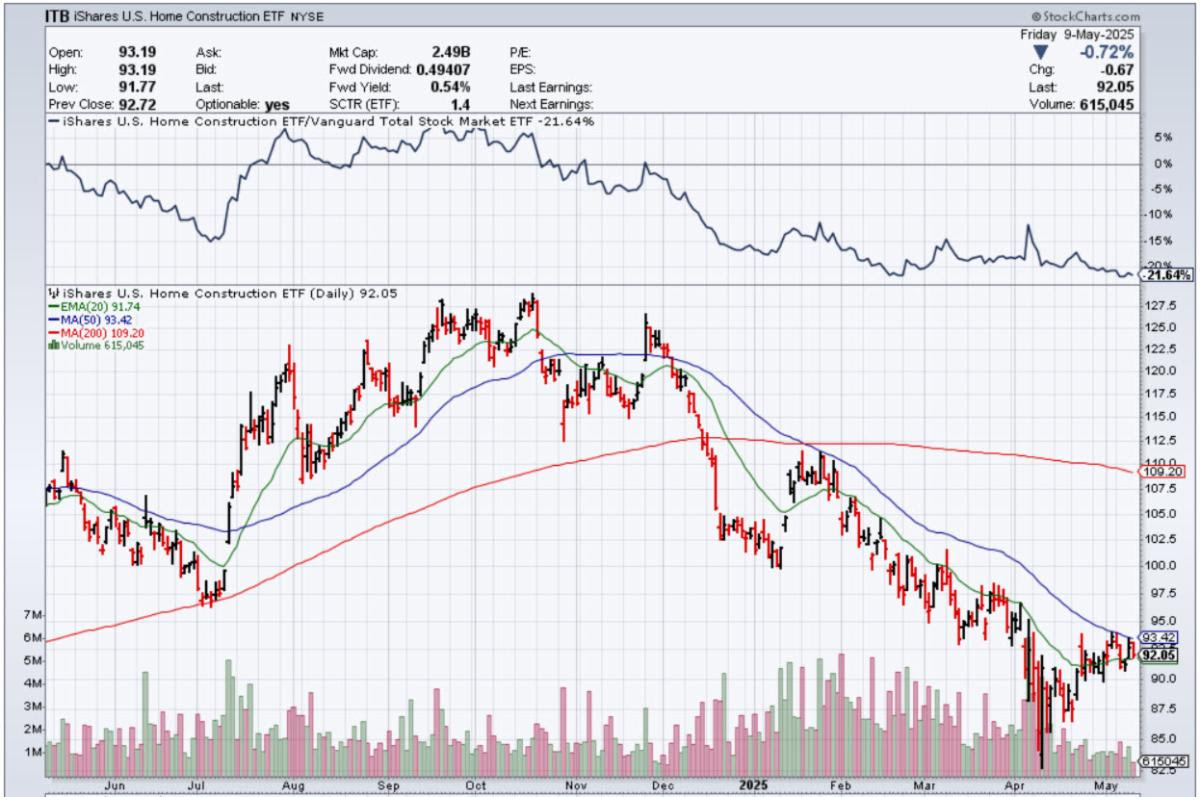

First off, as you may already know, home building/construction stocks have had a dismal stretch for several months now.

This is as market interest rates stay high (mortgage interest rates with them, of course) and may well be higher still in the coming months, as I discuss a bit below.

There's one noteworthy exception though: a construction company that will be unveiled to my Members before the market opens on Monday.

In part on the strength of three monster new contracts for construction announced in the last month or so (one of which I'll be visiting this coming week with the C.E.O.) this looming new recommendation is near its 2025 high.

This is one of the most solid and no-brainer stories you'll find.

If you're not a Member already, go to my Membership page RIGHT HERE, where there's a few days remaining before our price increase is operational.

______________________________

Next, a new C.E.O. interview this week is with Ian Paterson of Plurilock Security, Inc. (TSXV-PLUR; OTCQB-PLCKF).

You've already heard me for a while now stress the renewed importance of the cyber security sector. It's one that I'll most assuredly be ramping our exposure up to as the circumstances/stories warrant.

But for present purposes, you'll learn--in part when you hear what the ACTUAL MISSION of D.O.G.E. is, and how it affects this discussion--all the reasons why Plurilock shares are a potential mind-blowing bargain at their present price.

You can watch this especially meaty interview RIGHT HERE or by clicking on the above graphic.

______________________________

I also discussed cyber security, other of my thoughts in this space and the broader markets, tariffs and more in my latest visit with Michael Patrick Leahy on his show this past week.

We also discussed Warren Buffett's retirement and legacy...story stocks (including a rather stark statistic on investing in them from The Great Depression) and MUCH MORE!

Go RIGHT HERE for the first segment and HERE for the second (audio versions.)

____________________________

Also this past week, as promised and as usual, The Prospector News' Mike Fox and I recorded our usual Fed meeting post-mortem, which you can listen to RIGHT HERE or by clicking the below graphic.

This is an especially hard-hitting and important discussion, even if the F.O.M.C. meeting itself didn't deliver much more beyond what was expected.

Among other things, I discussed the slow-motion budget train wreck in Washington, which the R.I.N.O. House Speaker Mike Johnson continues to make worse with the ignorant and tacit approval of the president.

All this is going to keep upward pressure on market interest rates going forward.

We also shifted gears along the way to discuss the ongoing challenges to both President Trump and Canada's Prime Minister Mark Carney when it comes to reinvigorating domestic extractive industries and their corollaries.

It's not a pretty picture.

We discuss, too, how a lot of sobering issues (and, yes, still some hopeful ones) along these lines will be discussed at the upcoming Critical Trends in Mining Finance conference in New York, put on each year by the New York Section of the S.M.E. (GO HERE for the skinny on the conference, which is one of the most important of the year bringing together not just companies, but government, public policy, banking and other folks.)

Among other things, Yours truly will head up a panel on nuclear energy's renaissance and its present/expected future progress.

And already, I've recorded another presentation, discussing the president's recent Executive Order on permitting reform, etc...together with (sorry, folks) the very false sense of security it has given many.

That already-recorded discussion is not yet publicly available...but I'll let you watch the protected version (only 11 minutes; make sure you're sitting down!) RIGHT HERE.

______________________________

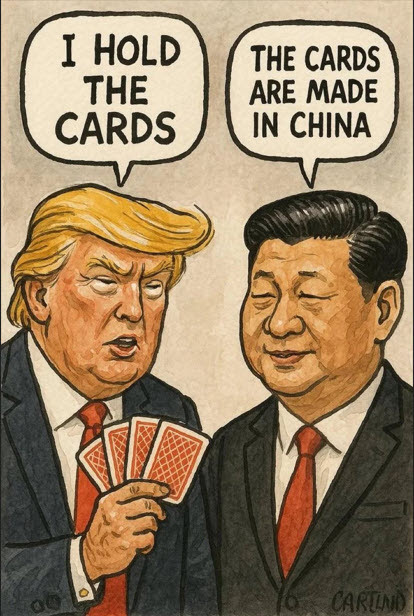

Finally, for now, we're about to see just how much China needs the U.S...and/or vice versa.

I may well be further modifying our portfolio mix come Monday (in addition to making my new company recommendation mentioned at the beginning) depending on what we hear after the weekend's confab in Geneva, Switzerland has concluded.

Expectations politically were properly dialed back ahead of the get-together between the U.S. negotiating team led by Treasury Secretary Bessent and their Chinese counterparts.

Trouble is, markets in their recent bear market rally act as if everything is already certain to go well here and otherwise.

At best this is all going to be a painfully slow process; and does not have a happy precedent from the days of Trump 1.0 to begin with, as Gordon Chang pointed out a little earlier today in a Fox News interview which you can and especially should watch HERE.

At worst, there are reasons why both sides would rather dig in and not "give" much, no matter the consequences.

All the best,

Chris Temple

Editor/Publisher

Saturday, May 10, 2025

Don't forget that you can follow my thoughts, focus and all pretty much daily ! ! !

* On Twitter, at https://twitter.com/

* On Facebook at https://www.facebook.com/

* On Linked In at https://www.linkedin.com/

* On my You Tube channel, at https://www.youtube.com/c/