Greetings, Investors! As the year nears its end, precious metals have added an exclamation point to one of their greatest years on record.

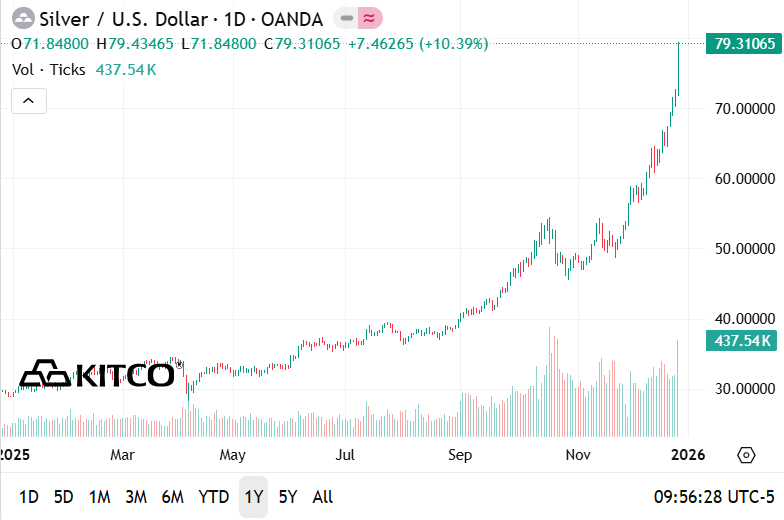

The performance of late has been led by silver's relatively sudden, HUGE spike. As if a light switch was flipped along about the middle of last month, silver's grudging game of "catch up" suddenly exploded upward.

Some pricing over the weekend has shown an ounce of silver north of $80 now!

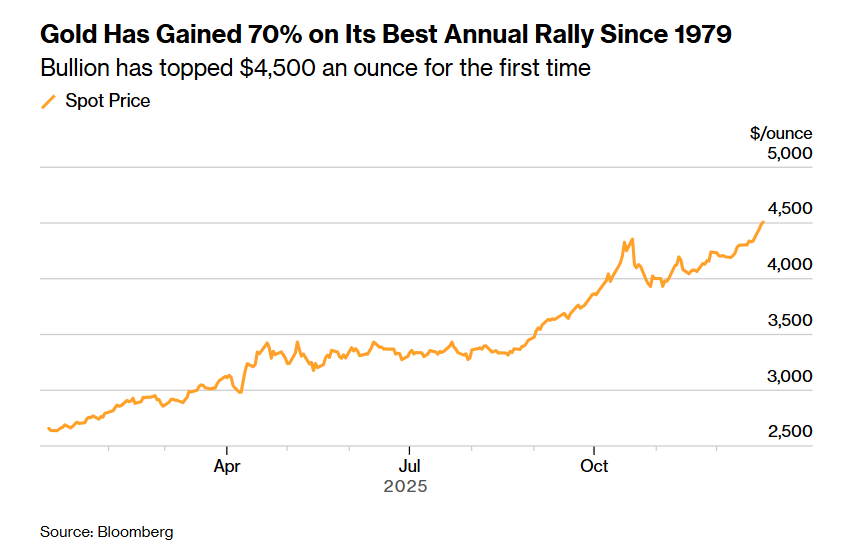

Not to be left in the dust, the gold price has in fairly short order shaken off its mini-correction from the fall and has just made a new high, moving above $4,500/ounce for the first time.

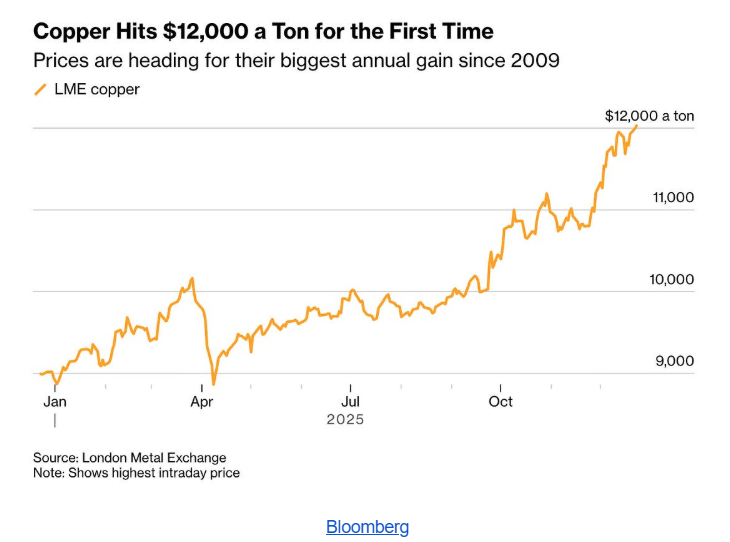

Copper has led a rally in many of the previously-stodgy base and even battery metals; as you see below, that red metal is also in nominal record territory.

Even platinum and palladium -- little discussed in relative terms against these others -- have been on fire.

In my email to you on Monday, I shared the link to my most recent Your Money Today, summing up a lot of what has led to these moves in 2025.

You'll be hearing a lot more, too, as we move into 2026 in the coming days! (NOTE: And our Members ahead of mid-week will be getting further portfolio instructions.)

______________________________

For present purposes I want to share two more videos today:

First, by CLICKING HERE or on the below graphic, you can watch a fresh video profile/update of Integra Resources (NYSEArca-ITRG; TSXV-ITR) via my discusson with C.E.O. George Salamis.

Soaring gold prices have turned Integra into a strong free cash flow and earnings machine; and further, they have accelerated development plans across the board with all three of the company's Great Basin projects.

As you'll hear, Florida Canyon is set to further undergird development plans at both DeLamar in Idaho (we discuss the just-released and very robust Feasibility Study there released just over a week ago) as well as Nevada North.

And Florida Canyon itself will be the focus of accelerated development to extend its present five - six year mine life.

Notwithstanding the possibility of a near-term pullback for white-hot silver especially (and more of a two-way market as I discussed in my last email) the long-term picture for Integra remains superb, even after its five-fold or so increase from early this year.

Listen in to all the reasons why!

______________________________

Next, not many days prior, I caught up once again with Cali Van Zant of InvestorIdeas.com and Andy Bowering, Executive Chairman of Apollo Silver (TSXV-APGO; OTCQB-APGOF).

You can watch this discussion RIGHT HERE or by clicking on the below thumbnail.

Of course, Apollo's own five-plus- fold gain this year is due more directly to the silver price spurt. Its Calico Project in San Bernardino County in California--one of the largest silver resources in North America--is moving ever more toward development.

But Andy joined us most recently to update us all on another story: the company's option on the HUGELY prospective Cinco de Mayo Project in Mexico.

For those who have followed us along the way here, CdM is an asset potentially even more spectacular than Calico. And as Bowering lays out, the company recently reported RIGHT HERE, that discussions are advancing with the local community there to win back the social license on this project previously lost by a different company.

VERY exciting stuff here; and keep in mind that Andy already has a deep and successful history in Mexico and is well thought of there, as here. (AND for good measure, you'll hear some encouraging news on the broader, surprisingly healthier environment in Mexico for the mining industry!)

______________________________

REMINDER: If you have not already listened to my 2025 wrap-up on "The Math" affecting the economy, policy, various asset classes and more, LISTEN IN HERE.

Indeed, it might not hurt to listen again!

In fairly short order, we're likely to see markets react more notably to that three-way "duel" depicted above.

It's more likely than not, too, we'll be "enjoying" (in some ways, I suppose, though October's shutdown gave us a record monthly deficit for that month!) yet another logjam/government shutdown come the end of January.

Bear in mind as well that money managers needing to show they were involved up to their eyeballs in everything from the record stock market run to even many of these metals stories will have no such compulsion once we flip the calendar.

So, again: our Members can expect a fair bit of repositioning over the coming few weeks or so along with selective further profit-taking AND getting rid of a bit more "dead wood."

AS ALWAYS -- feel free to pass along your own comments/questions!

All the best,

Chris Temple

Editor/Publisher

From the desk of Chris Temple -- Sunday, Dec. 28, 2025

Don't forget that you can follow my thoughts, focus and all pretty much daily ! ! !

* On Twitter, at https://twitter.com/

* On Facebook at https://www.facebook.com/

* On Linked In at https://www.linkedin.com/

* On my You Tube channel, at https://www.youtube.com/c/