Greetings, Investors! Over the many years I've been doing all this, we've had a few especially successful outcomes after buying what an old friend of mine once termed as "donut holes."

Essentially, this simply means ground within known mines or development projects that are farther along but owned separately.

The idea, of course, is that if LOTS is going on all around said "donut hole", then maybe that surrounded area--provided capable management and enough money is also brought to bear--will also reveal itself as having economic metals resources.

Last week I recorded fresh updates with two such stories among those on my recommended list:

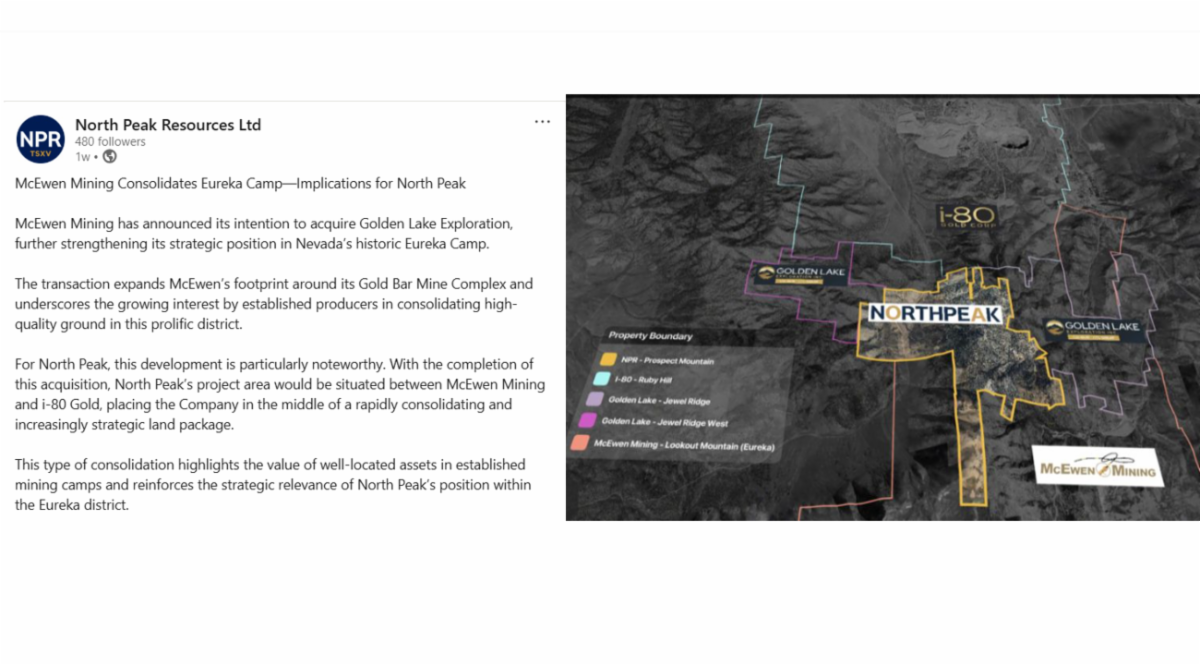

RIGHT HERE (or by clicking the above graphic) you can listen to an update with North Peak Resources, Ltd's (TSXV-NPR; OTCQB-NPRLF) C.E.O. Rupert Williams.

There's been recent news augmenting our thesis here on two fronts recently.

First--as you'll hear--progress has been made toward not one but two potential sources of initial cash flow/development at the Propsect Mountain Complex.

Secondly--and more tantalizing on the "donut hole" front--McEwen Mining (which already has an advanced project southeast of North Peak) just announced it's acquiring Golden Lake Resources, further surrounding Prospect Mountain. (i80 Gold remains the big neighbor to the north.)

As I've been covering and as Rupert reminds us, among the unique attributes of Prospect Mountain is it has had virtually no modern exploration over the last few decades. That's changing now under the leadership of him and Chairman Harry Dobson; and I'm uber-excited to watch this story catch up to its neighbors!

______________________________

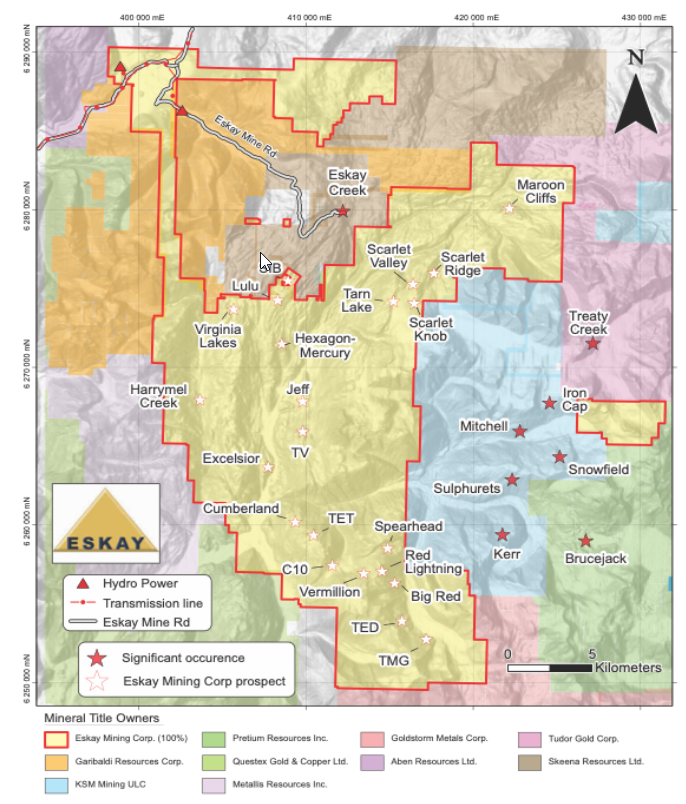

Most recently--and for reasons that are roughly similar--I added Eskay Mining (TSXV-ESK; OTC-ESKYF) to my list of recommendations. Here too, Eskay is surrounded by some BG NAME neighbors and assets:

--> The high grade Brucejack Mine (Newmont)

--> Seabridge Gold's KSM (with the highest gold and third-highest copper resources on the planet)

--> Tudor Gold's up-and-coming Treaty Creek

--> and to the north the famous Eskay Creek Mine, now readying for its second act under Skeena Resources.

As I discussed when I first recommended Eskay, I've kept in touch for years with C.E.O. Mac Balkam (who I was pleased to be able to spend some time with this past weekend.)

Given all the factors adding to the location that have come into play over time, as we covered in OUR FIRST DISCUSSION a few weeks back, I'm of a mind that this "donut hole" has the table nicely set for it as well!

One of the several reasons is the geological brain trust that Mac has assembled. And one of its key members is Dr. Quinton Hennigh, who--in addition to having served as the company's Q.P. (Qualified Person) for public filings--is also a Director and significant shareholder of Eskay.

He's one of the biggest names in this space as many of you know.

As promised when I did the video with Mac and his V.P.-Finance Rob Myhill, I did a follow-up one with Quinton RIGHT HERE.

And he very capably, succinctly and understandably explains why everyone is drooling over this 130,000 acres that Eskay holds in such prime country!

It's hard and expensive work in this region, of course; and as with all exploration a LOT goes into decision-making. Soon we'll be hearing the specifics of the key, initial targets for drilling in 2026's program (Mac suggested when we visited Saturday that he hopes to have the particulars out ahead of the P.D.A.C. gathering in Toronto next month.)

______________________________

Over the weekend, Japanese Prime Minister Takaichi's gamble to hold a snap election paid off big-time: her Liberal Democratic Party now has a super-majority of 316 out of 465 seats in the lower house of Parliament, up from the previous 232.

And now Takaichi has a powerful mandate to:

--> Further weaken the yen (albeit at the expense of continuing rises in interest rates, INCLUDING on the part of the Bank of Japan.)

--> Really blow out the public finances with "stimulus" measures.

--> Keep Japanese stocks and other assets rising to compensate.

(Does all of this sound familiar?)

Just when you think that heady combination has finally run its course in this country (Thursday) we get yet more panic, bubbly buying (last Friday.)

Yet some damage has been done, notwithstanding the Dow Industials' record close north of 50K.

And who knows how long it will last before (chiefly) continuing high market interest rates exert more weight on all these various asset bubbles?? I don't see Bitcoin remaining such an outlier, though it is somewhat a canary in the coal mine.

We can't say we haven't been given the playbook. President Trump especially has taken a "Let them eat cake" attitude of late towards the hoi polloi who don't already own real estate and stocks.

To him as well as most of his team, they likewise will continue pursuing a game plan of goosing monetary growth and asset prices to reward those who already have sufficient assets; and hope that the ever-shallow MAGA rhetoric keeps enough on board that Republicans don't get hammered in November's mid-terms.

As last week showed anew, it's tough to be a big better in either direction on a generally overpriced market; but one which still has actionable individual stories and sectors in it.

Those "donut holes" within the broader stock market have been serving us well for the most part -- and I'll have some added thoughts for our Members this week on where we go from here (and especially on the implications of Japan's now-accelerating policies.)

All the best,

Chris Temple

Editor/Publisher

From the desk of Chris Temple -- Monday, Feb. 9, 2026

Don't forget that you can follow my thoughts, focus and all pretty much daily ! ! !

* On Twitter, at https://twitter.com/

* On Facebook at https://www.facebook.com/

* On Linked In at https://www.linkedin.com/

* On my You Tube channel, at https://www.youtube.com/c/