Greetings Investors! It's well known for those who follow or are invested in the sector that, by and large, precious metals-related stocks have done a poor job of keeping up with the strong 2024 run in the metals themselves (especially gold.) However today I have a new player for you to discover, Borealis Mining.

There are a host of good reasons for this, frankly. I'll be discussing them and a LOT more anew very soon in a coming update to my popular Special Issue I dust off and update every now and then.

Among the items you'll be reading in the next "This is STILL NOT Your Father's Gold Market!" is a checklist of the attributes of worthwhile individual companies for your portfolio; ones that are appealing to investors NOT already up to their eyeballs in PM's and related equities.

For today's purposes I want to give you a look at one of my newest additions: Borealis Mining (TSXV-BOGO), which neatly checks those boxes!

Among them is the importance of the "jockeys" involved, as you'll hear me discuss with the Borealis Mining's C.E.O. Kelly Malcolm in the latest video interview I posted with him RIGHT HERE.

And beyond Malcolm's own bona fides of being a major influence in Amex Exploration's Perron Project in Canada before he scooped up this present, impressive project in Nevada's Walker Lane Trend, he's joined by numerous other successful "jockeys" who have piloted projects and entire companies to GREAT success (and BIG PROFITS for investors.)

Among them are Rob McEwen (pay especially close attention to the story of how and why McEwen obtained his significant stake in Borealis Mining!), Eric Sprott, Kinross Gold Founder Bob Buchan and others.

In the same company we have both sporadic cash flow already (on the way to expected full-time production being renewed in mid-2025) AND significant exploration upside.

And Malcolm's game plan to build a broader company on the foundation of the Borealis Project is uber-impressive; and very doable.

You'll be hearing more about Borealis Mining and certain other of my current recommendations in the upcoming special issue...for now, be sure to WATCH my interview with Malcolm and consider Borealis for your portfolio.

______________________________

Moving on, some of you have listened to and/or read my podcasts, commentaries and more on the challenges facing President-elect Donald Trump once he takes office in January.

And as ever, I call things as I see them; and while hopeful--especially if Trump 2.0 really does think and act outside the box in some ways--I remain sober given the massive deficits he's going to be starting from in some respects (and not just that $36 trillion national debt and $3+ trillion annualized budget deficit he needs to reckon with.)

I also acknowledge--and will be explaining anew in the days ahead--that what seems to be Trump's game plan concerning what will be Trump 2.0's biggest economic/trade challenge (again) is, at best, woefully incomplete.

At worst, it's delusional.

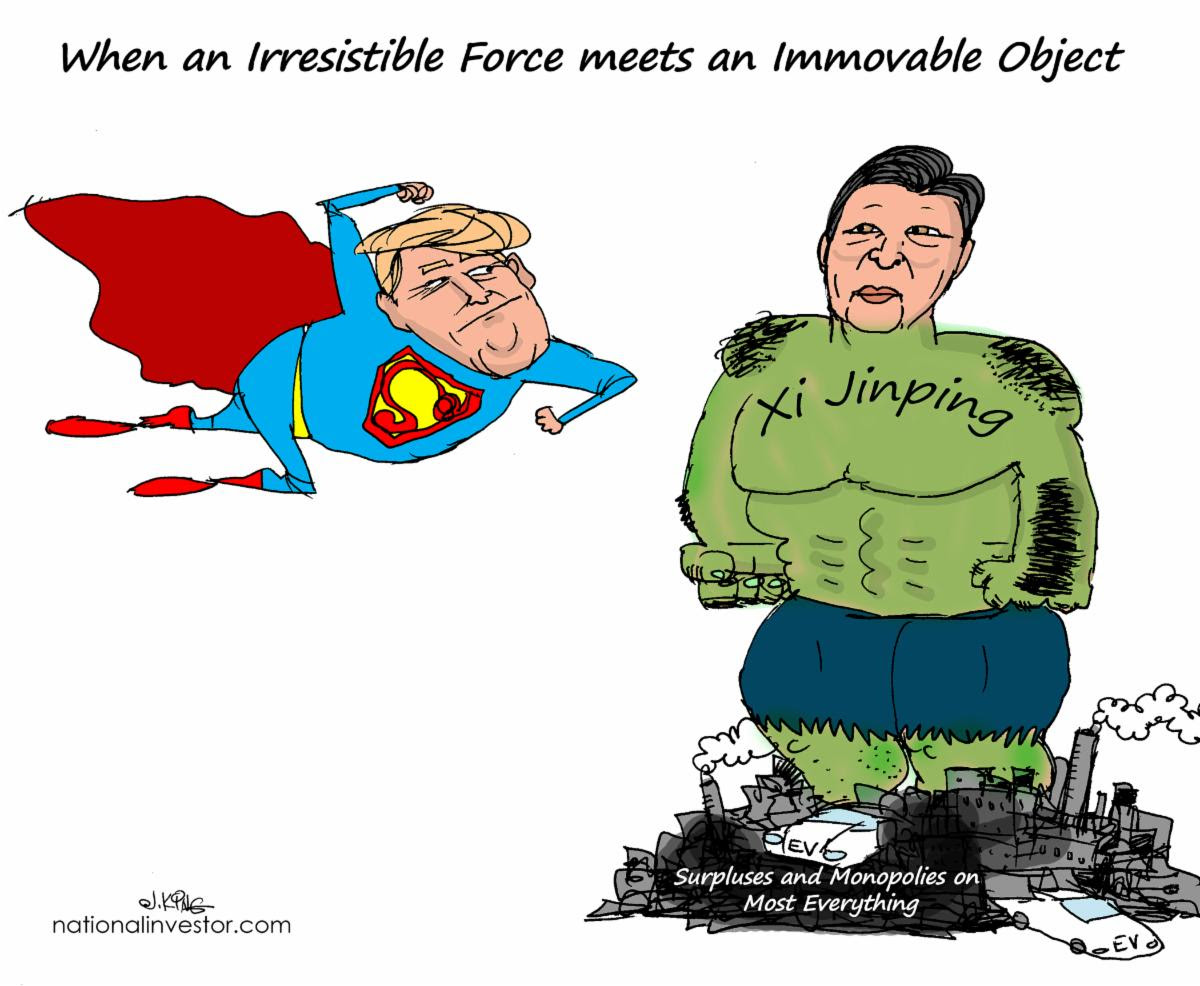

I've already discussed somewhat in recent times that there will be NO easy way to "square" two diametrically opposite situations in the ongoing and soon-deepening trade war between America and China:

*The U.S. with lingering inflationary pressures vs. China valiantly fighting "Japanification" and full-on deflation.

*The U.S. with the present trade detriment of the world's strongest fiat currency vs. China, where monetary authorities have weakened the yuan and where interest rates are less than half of America's levels.

*The U.S with still scant "food chains" for base and critical materials, vs. China with MORE than enough and near monopolies on many things we can't do without. All of them cheap.

*The U.S. is still a massive net importer, vs. China with a total $1 trillion trade surplus and counting. And on that broad issue especially the math just does not work for the U.S. to change this competitive landscape any time soon; China needs more than ever to dump cheap, surplus production of almost everything on the rest of the world...OR IMPLODE financially (and take everyone with them for a while.)

The odds are non-existent to change this equation in America's favor any time soon. I'll be explaining why in the days ahead; and also discussing what can be done to begin what will necessarily be a lengthy process to wean us off cheap Chinese imports/critical materials dominance.

It is going to require a solid, well-thought out and years-long process. The risk is that if Trump sticks anywhere close to his campaign rhetoric and seeks to use trade, tariff and other sledge hammers to undo quickly what took decades to screw up, the cures may well be worse than the disease.

Stay tuned...

All the best,

Chris Temple

Editor/Publisher

Saturday, November 23, 2024

Don't forget that you can follow my thoughts, focus and all pretty much daily ! ! !

* On Twitter, at https://twitter.com/

* On Facebook at https://www.facebook.com/

* On Linked In at https://www.linkedin.com/

* On my You Tube channel, at https://www.youtube.com/c/