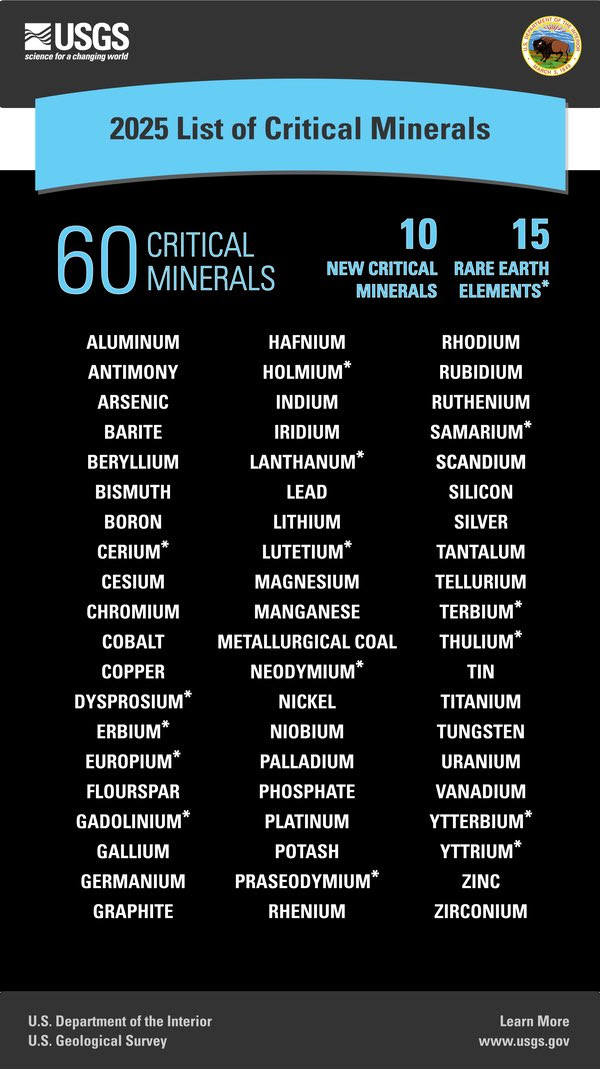

Greetings, Investors! The U.S.G.S. has unveiled its updated list of critical minerals as you see below; and the press releases have been flying out of mining company offices!

Silver, copper, uranium, phosphate and more additions have folks cheering...and believing that substantive and economically sufficient tools will now be employed by the federal government to really revive all these industries in the U.S.

BUT...with one notable exception as I see it still being uranium/nuclear energy...America even under President Trump is STILL bringing a water pistol to a gun fight.

There ARE good intentions...and there HAVE been some good initial policy moves in this first year of Trump 2.0 (such as Interior Secretary Burgum's renewed call for strategic reserves for many more substances than just crude oil and the nascent uranium reserve.)

Don't get me wrong. I applaud steps taken so far; and in principle, some of the Administration's "investments" in various projects (more to come on this!)

However, as I will continue to point out, we need to be:

--> Realistic in our expectations, given America's many institutional and budgetary headwinds...

--> Braced for how ALL these various "causes" will be set back if the overall financial markets finally are forced to reckon with both math and gravity and take everything down with them for a spell and

--> Choosy over which stories we place our bets on, at least for the near term.

RIGHT HERE, you can listen to one of the interviews I did with colleagues Cory Fleck and Shad Marquitz at last week's BIG New Orleans Investment Conference (a bit more below) on these thoughts.

As always, I call things as I see them!

And--as guardedly optimistic as I am for the long term--I inject some sobriety into the mix when it comes to the discussion of just how quickly we're going to see the kind of broad industrial and investment policy needed to do the job RIGHT.

Along the way, we talk about several of the president's moves to date (Ambler Road, Trilogy, MP Materials, Lithium Americas, etc.) and the MUCH bigger policy debate this is beginning to engender.

For present purposes, I opine that uranium remains the best and relatively safest story on the U.S.G.S. list for investors.

And I throw out a bit of a curve ball, too, in flagging so-called fossil fuels as worth more attention than they are getting right now!

______________________________

A BIG CONGRATULATIONS -- and thanks! -- to my friend Brien Lundin, Editor of Gold Newsletter and long-time proprietor of the New Orleans Investment Conference franchise (Below, with C.E.O. Tara Christie of Banyan Gold.)

Understandably, with gold's tear of late and with the myriad other commodities- and markets-related stories garnering folks' attention, attendance this year spiked to over 1,000; the first time that number has been reached in quite a while!

And as many of us observed/shared with one another during a PACKED 3 1/2 days, the surge in attendees seemed to be of 1. some "new blood" and 2. serious investors NOT there simply for the food and to hear their favorite guru(s.)

They were serious...and with their sleeves rolled up!

Gold, of course, was still center stage for most folks; and for good reason. As I'll be describing further in the next Members issue of ours going out soon (a bit later than intended; my body has been rebelling against me after all the recent activities and insisted I throttle down!) the yellow metal has a much different foundation today than during past blow offs/consolidations.

What I also found interesting--and encouraging--at the N.O.I.C. is that many (including many of the speakers) do NOT have the "Deification" strain of T.D.S. (that's Trump Deification Syndrome if you didn't know; an affliction that leaves some people as incapable of rational thought and debate as the "Derangement" strain.)

Thus, there was a lot of skepticism from what is still happily more of a core libertarian crowd over a lot of President Trump's budgetary, "investment" and related practices.

This goes especially to the Trump Administration in various ways having taken equity stakes in various companies in recent months; something which--as said above--I tend to agree with in principle BUT which is hardly something the federal government should be doing--some argue--in our system of government.

It's an important policy debate for America to have.

More to come on this, including in the upcoming Members-only issue before week's end.

______________________________

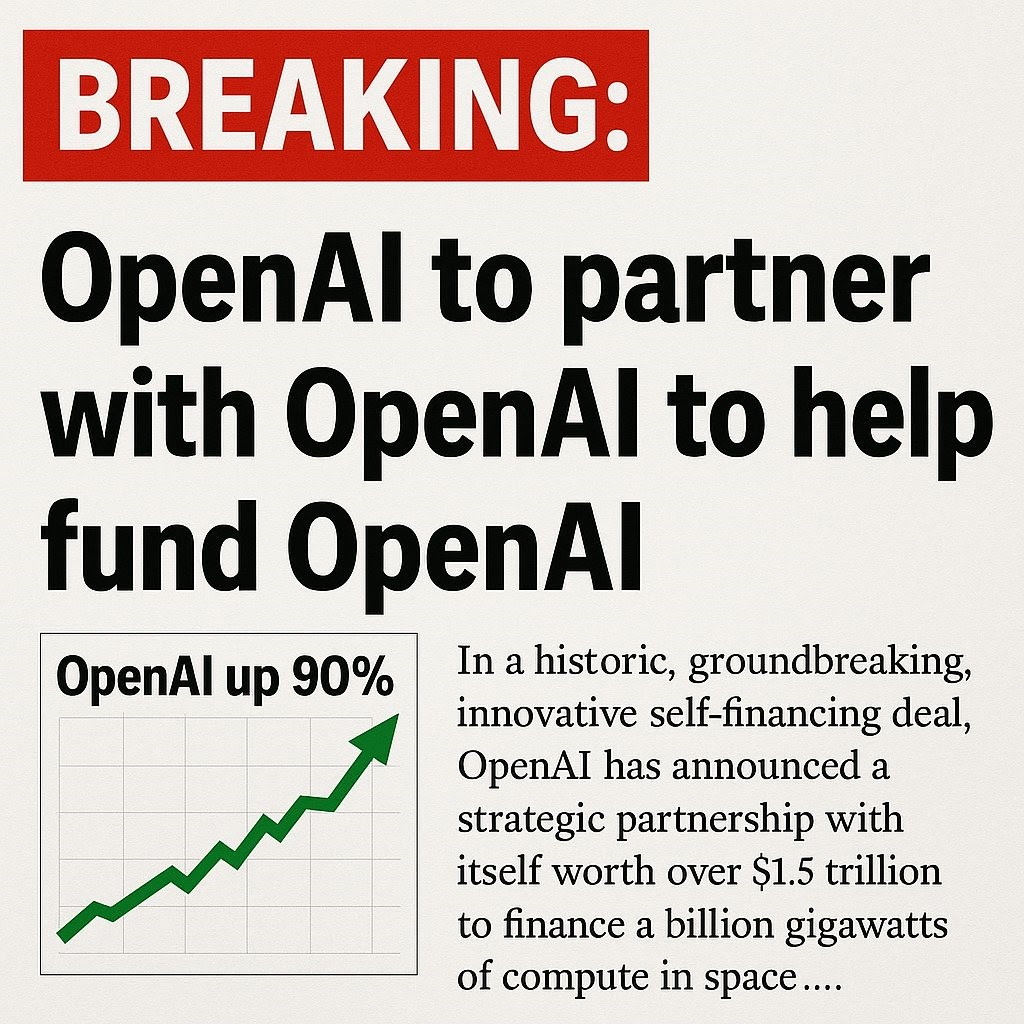

I wish that a fraction of the attention and money was devoted to critical metals, energy, their full supply chains and more as we've seen allegedly committed to A.I. and such.

Among other things, at least some of those investments would be more REAL than the "daisy chain" of flim-flam I've been sharing a lot with you lately on when it comes to purported A.I. deals.

Ever the hyperbolic carnival barker, too, President Trump has encouraged what I feel deep down is a false sense of security over just how much money is actually going to be invested in the U.S....and invested in something REAL that will benefit the broad population.

Recently, his running total has been upgraded: in the last few days (including in his newest interview with Faux News' Laura Ingraham, with a dizzying mix of stuff for sufferers of both strains of T.D.S. to love and hate alike) the president now claims we'll be at $21 trillion of new total investments in the U.S. by year-end.

I feel like starting a pool where the participants have to pick the date at which the president uses the word "gazillion" to further upgrade his number!

But hey--as I said above where some early moves on fostering critical materials is concerned--something is better than nothing...I guess.

BUT especially here, dangerous bubbles are being made more so, I.M.O., with this flim-flam over purported A.I. investments especially (and the associated news breaking this week over Big Tech's accounting trickery to suck in money and grow even bigger bubbles.)

How long will all this hold together?

I don't know.

We'll handicap all that in the upcoming issue as well, in part by my updating everyone on our trimmed "long" positions in some areas... I'll advise selling some "dead wood," ... and take another step or two toward a more sober/defensive overall allocation.

The temporary "truce" in Washington and--likely before week's end--the end of the Democrat Party-inspired government shutdown is buying the bulls on Wall Street a bit more time as I write this.

BUT--as I said where the Xi-Trump "truce" was concerned several days back--the big picture still hasn't changed.

The wise will be trimming their sails accordingly.

All the best,

Chris Temple

Editor/Publisher

From the desk of Chris Temple -- Tuesday, Nov. 11, 2025

Don't forget that you can follow my thoughts, focus and all pretty much daily ! ! !

* On Twitter, at https://twitter.com/

* On Facebook at https://www.facebook.com/

* On Linked In at https://www.linkedin.com/

* On my You Tube channel, at https://www.youtube.com/c/