Greetings Investors!

Not since the heady days of 2010-2011 have investors in precious metals and their associated equities (most of them, anyhow) made the kind of money that we've seen in recent months.

And there are a host of reasons why, long-term, gold's story especially remains robust.

Yet near term, odds are high that the parabolic move in gold (and, likely, the more recent catch-up one in silver, though there is one BIG "wild card" with it!) is going to correct or consolidate.

I'll be discussing those probabilities...what would cause this...and how to position yourself more so in the days immediately ahead.

For present purposes, the fact that this bullish move will only be interrupted, potentially, for a spell argues for some repositioning of your exposure to precious metals stocks especially.

In recent days I've been advocating some selective profit-taking on our best positions...

...and am reminding folks that there remain a number of great stories among exploration small-and micro-caps which haven't moved that much.

Yet.

One of my more recent additions (with more to come shortly!) was of North Peak Resources, Ltd. (TSXV-NPR; OTCQB-NPRLF).

I implore you to watch THIS LATEST CONVERSATION I just posted with its C.E.O. Rupert Williams.

You'll learn of a massive project--with notable past production, tens of millions of dollars' worth of infrastructure, and several gold and base metal targets that time passed by...until now.

And this unique project is not in some far away jungle or desert...it's in the top mining jurisdiction of Nevada...and sandwiched between great discoveries on the part of i80 Gold, McEwen Mining and others!

There's HUGE "blue sky" here, I.M.O.; and after you check this story out, I'm confident you'll agree.

________________________________

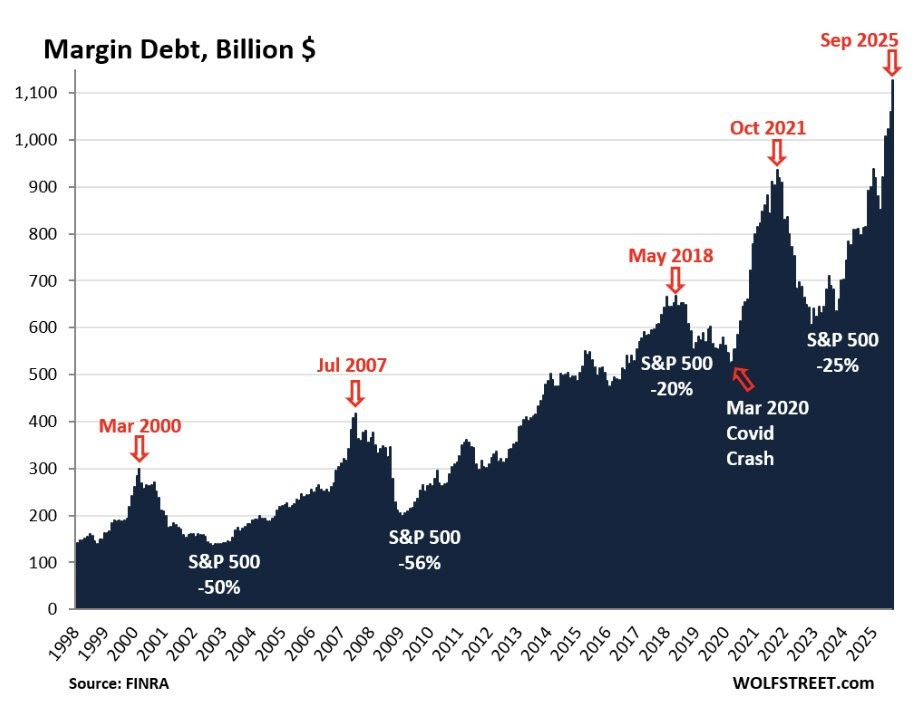

Another chart that I have my eye on that's gone parabolic--and here, too, it eventually corrects or even crashes sharply--is that of margin debt as you see below.

My friend Wolf Richter just put out a FRESH COMMENTARY about why this spike is especially relevant--and a likely harbinger of a more notable correction--now.

And this crazy leverage and associated speculation is indicative of the same in so many places, as increasing liquidity (in part, as the Fed is being faced again with the kind of "plumbing problem" a la late 2019 that prompted it to start shoring up the banking/credit system before the COVID Plannedemic gave Powell & Company carte blanche to really open the floodgates) collides with a renewed deterioration in the credit markets.

Folks, this always ends the same, as a matter of simple mathematics.

And it's why NO gains in your portfolio in any sector are completely safe right now.

So the overdue correction of the massive credit cycle unleashed in 2019/2020 is one BIG macro factor we seem about to reckon with more notably.

The second one is the evolving global trade war, with the associated World War 3 over Commodities/Currencies and the US v. China tussle specifically.

We'll be learning in short order what both sides' intentions are near term to defuse the recent angst...or not.

Here, though--unlike with "Macro Issue No. 1"--the risks are in both directions, depending on what sectors we're talking about.

I'll be unpackaging that further in the near future...as well as adding further portfolio changes for our Members on top of the numerous ones of the last couple weeks or so.

All the best,

Chris Temple

Editor/Publisher

From the desk of Chris Temple -- Tuesday morning, Oct. 21, 2025

Don't forget that you can follow my thoughts, focus and all pretty much daily ! ! !

* On Twitter, at https://twitter.com/

* On Facebook at https://www.facebook.com/

* On Linked In at https://www.linkedin.com/

* On my You Tube channel, at https://www.youtube.com/c/