Good morning Investors!

Either late today or tomorrow I’ll send along another “regular” new issue with some expanded broad market and allocation thoughts…but for now, I want to pare back our inverse ETF exposure by taking some small profits on both SQQQ and SOXS. Sell those positions in their entirety.

Markets may be set to rally farther than what the pre-market is showing, as–chiefly–a tariff-schizophrenic President Trump once again is suggesting he’ll pull back at least in part on some tariff plans. That has not been defined as of yet but could include something to do with Canada per the request of Alberta’s Premier Danielle Smith regarding the now-quickly approaching federal election in Canada.

I’ll be opining on all that in the next issue, of course!

And in any case, as I’ll explain, I want to stick chiefly with my base case economically and market-wise, as I’ll repeat it in that upcoming issue.

____________________________________

NEW RECOMMENDATION:

Plurilock Security, Inc. (TSXV-PLUR; OTCQB-PLCKF)

Friday’s close– C$0.28/sh, or US$0.196/sh.

A key part of that “base case” going forward is that stock market rotation already underway (albeit in fits and starts at times) will help focus attention on evolving trends/sectors whose fate will be decided independent of macro market factors.

Indeed, as the broad stock market continues to be more realistically repriced in the months and years ahead, that will force investors to at least partly abandon the “passive” game and investigate breakout stories/companies.

As I discussed in last Thursday’s email, protection against a new wave of weapons against data storage is one of those up-and-coming needs/sectors independent of the broad market. Indeed, last week’s BIG NEWS of Alphabet/Google’s $32 billion acquisition of cloud security provider Wiz speaks to this.

In the case of Plurilock, the company offers several different services: from more hands-on IT management to SAAS offerings. What’s more, they offer to investors an especially timely opportunity now to take a position in the company at a weak point in the market price (explained below) even as the company’s progress, revenues and outlook, as I see them, dwarf the present share price.

As I’ll be discussing in further detail in the next issue you’ll receive on the heels of this note, Plurilock has already exhibited an ability to be a consolidator in an industry that is newly “fragmented.”

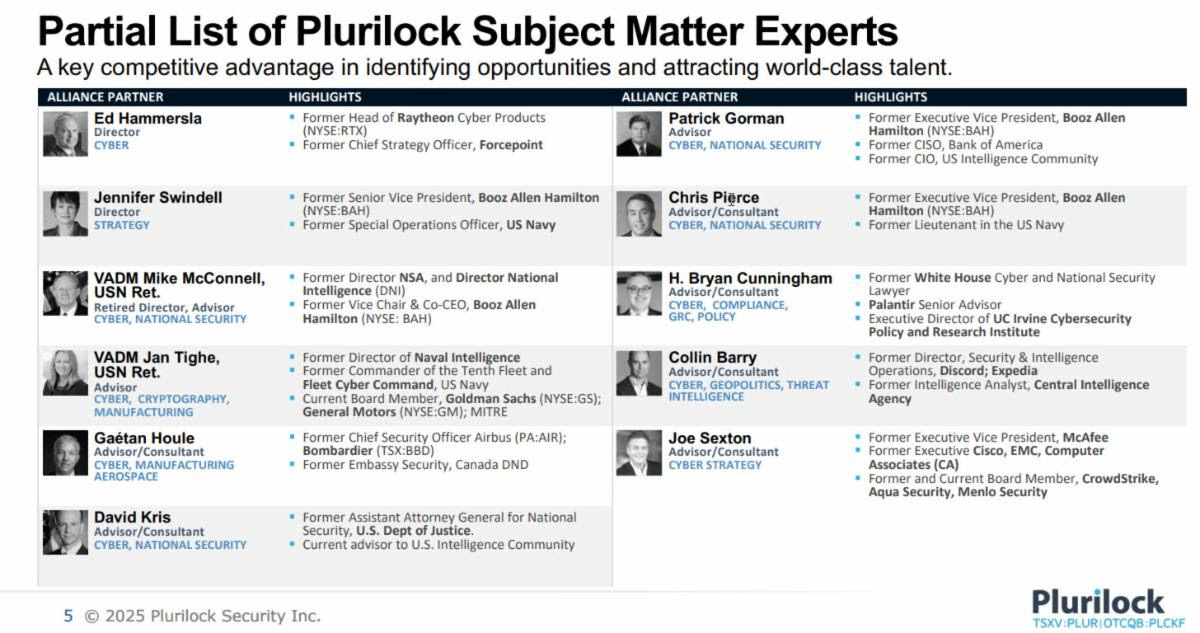

Further–as it has put together an astonishingly impressive “brain trust” to further its offerings and contacts (see below) –Plurilock has been scoring an impressive amount of business with government agencies in both Canada and the U.S. As the company’s Executive Chairman Ali Hakimzadeh confidently laid them all out to me when we first spoke, the Board of Advisors his crew has put together is “second to none.”

And though Plurilock is HQ’d in Vancouver, B.C., Canada, about 90% of its revenue (about C$70 million in 2023 and likely in that neighborhood again once full-year 2024 numbers are out) is from the U.S. Half is from government business and the other half from commercial customers.

And I am especially intrigued at the prospects for both going forward: especially the government side given the mandate that the repurposed D.O.G.E. has where it concerns IT, software, data modernization and all for the entire federal government.

I’ll be adding more color in my next mailing to you on the company and its attractiveness to me. In the mean time I encourage you to spend some time at ITS WEB SITE HERE to learn more (That takes you to the main corporate page; a specific Investors link can be found there as well.)

But for the moment, I wanted to get this note to you ahead of today’s open, especially with the disconnect between its strong revenues/story…and a market cap that is only about a third of its annual revenues.

Of course, whenever I see a chart like that above, I have a couple immediate reactions/questions. Sure, if the story of the company sounds good, this might be telling me there’s an especially good entry opportunity.

Or it could mean there was something amiss prior and/or some parties playing games with the share price.

Having satisfied myself that the fundamental story of the company is sound and compelling, though, I still needed to understand the chart; and why we’re looking at a broken stock here and not a broken company.

As Plurilock’s C.E.O. Ian Paterson explained to me, last April–in part, led by a new investment group believing that fresh money and energy would make a difference–the company simultaneously rolled back its shares and did a financing. Subsequently, the share price spiked a couple times as you see, peaking around C$2.70.

As regularly happens, once the April-issued stock came out of four-month lock up, some folks sold to take profits. Others sold to exercise warrants which were in the money big-time. While that brought another C$2 million or so into Plurilock’s coffers, the net result was more selling in the market.

Short sellers then piled on, Paterson suggested; and the then-still fairly thin trading augmented the declines since, making PLUR a momentum play in the wrong direction.

Back now to the mid-2024 lows–and with the story as compelling as ever–I am of a mind that this proverbial knife has stopped falling and can now be caught.

So Plurilock Security is added to my list of Speculative opportunities as a BUY. (And it doesn’t have to prove too much more before I’ll upgrade it to my Growth roster; we’ll see what full-year 2024 results look like as well as progress toward turning present Gross profits into Net ones.)

_____________________________

NEW RECOMMENDATION:

Global Medical REIT (NYSE-GMRE)

Friday’s close — $8.37/share

Price/AFFO (2025 guidance) — 9.40; Yield — 10%

More of a quickie here; but again, with more color to follow.

At various times over the years when I thought the backdrop was attractive (or when I saw individual cases of compelling value) I’ve had a few different Health-related REITs among my recommendations. We’ve done very well over the years; but for a while I haven’t had any coverage since we last sold out of risky Medical Properties Trust (and should have bought it anew after it bottomed!)

I like Bethesda, Maryland-based GMRE, though it’s relatively small (a bit over a $1 billion market cap) due to its focusing on quality. Relative to some like MPW, its finances escaped largely unscathed from the financial issues of the last several years bedeviling a lot of these kinds of REITs, as weak tenants went under/had to reorganize and the REIT’s health was affected.

In comparison, GMRE experienced only slight “hits.”

This is because, as the company points out on ITS WEB SITE, Global Medical REIT targets quality properties in the healthcare system, emphasizing those operated by profitable healthcare systems and physician groups. As you get a feel for the company’s focus and culture, you’ll appreciate its “brag” on its home page that it’s “Nimble, Tenacious and Disciplined!”

Check out HERE especially its Q4, full year 2024 Earnings and conference call replay.

GMRE is started as an “Accumulate” and added to my recently growing roster of Income/Growth stocks.

And in the issue to follow–besides giving a couple more specific thoughts here–I’ll discuss further, too, how this is the latest example of my wanting to bolster areas that will work with my “base case” on the markets going forward.

All the best,

Chris Temple

Editor/Publisher

Monday a.m., March 24, 2025

Don’t forget that you can follow my thoughts, focus and all pretty much daily ! ! !

* On Twitter, at https://twitter.com/NatInvestor

* On Facebook at https://www.facebook.com/TheNationalInvestor

* On Linked In at https://www.linkedin.com/in/chris-temple-1a482020/

* On my You Tube channel, at https://www.youtube.com/c/ChrisTemple (MAKE SURE TO SUBSCRIBE!)

When you join me, among the many things you’ll be entitled to is my “Members Handbook.” It crystallizes my approach to the markets…asset allocation recommendations… how I select individual companies…and a LOT more.