Again this past week with our Konni Harrison, I picked up somewhat where we'd left off in the prior week's discussion I sent you last Sunday; that on "The Great Stagflation." This time, we discuss the changing of the guard on Wall Street.

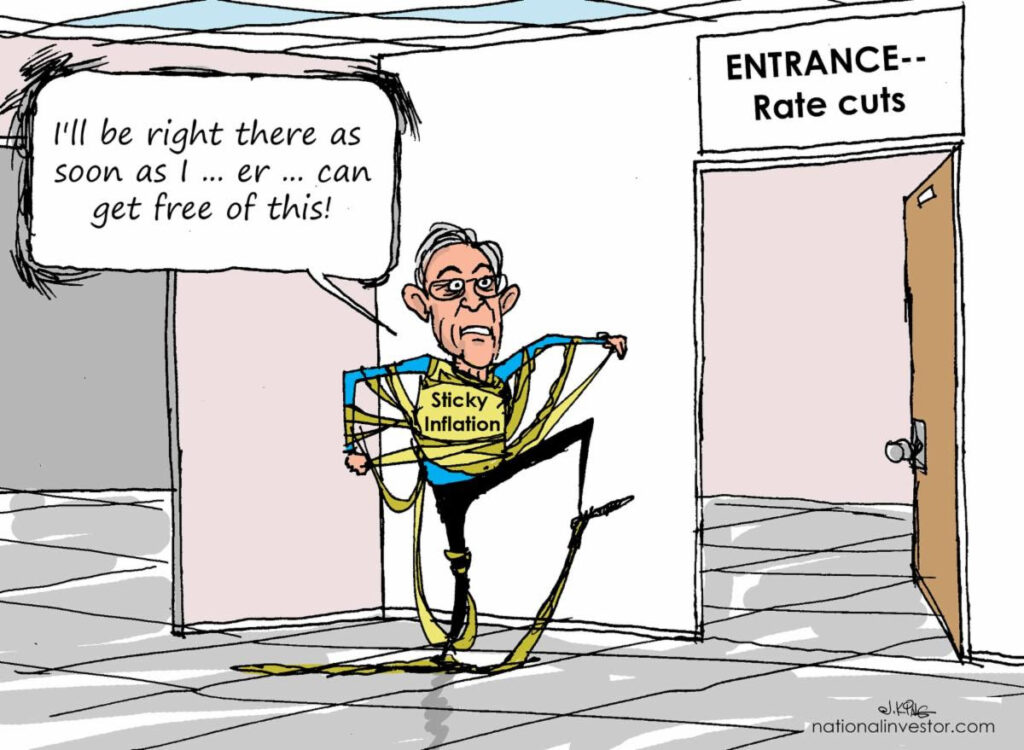

Since then, we learned from the Federal Reserve this past week--led by Fire Marshall Jay himself--that the central bank was now ready to admit what the rest of us already knew: that the Fed will NOT be cutting interest rates at all any time in the foreseeable future.

That added to the renewed urgency on Wall Street to flee overpriced "Mag 7" and other stocks and--in part--to redeploy capital into what is real and will prove resistant to if not benefit from The Great Stagflation. And that is the subject, chiefly, of THE NEWEST DISCUSSION from Konni and I just posted this weekend.

And that is the subject, chiefly, of THE NEWEST DISCUSSION from Konni and I just posted this weekend.

Going all the way back to The Great Depression, I chronicle several other instances such as that of the recent past when:

---> The "stock market" got obscenely top-heavy, with a handful of stocks surging higher as everyone piled in...

---> How each episode proved unsustainable...

---> How and why most other stocks/sectors were left by the wayside...

---> BUT the factors that led to some of them being aggressively "rediscovered" when the market darlings lost their air.

I.M.O. we have just restarted the process begun in 2022 but for a while reversed last year that will bring about this epoch' "Changing of the Guard"--something that Powell's admission will accelerate.

Don't forget that you can follow my thoughts, focus and all pretty much daily ! ! !

* On Twitter, at https://twitter.com/

* On Facebook at https://www.facebook.com/

* On Linked In at https://www.linkedin.com/

* On my You Tube channel, at https://www.youtube.com/c/