Greetings, Investors! 2025 is now in the books; another successful one for our Members.

Over the years, The National Investor has tended to actually slightly underperform the broad markets in big up years; but vastly outperform when it comes to "blah" or, especially down ones.

The greatest example ever, of that latter, was back in 2008: a year in which you were basically EVEN if you followed our portfolio recommendations, while the broad market indices were down 40%+.

This last year, my ambivalence (at best) on the broad stock market was too pessimistic.

Yet we managed to nearly triple the S&P 500's 16% gain for the year when all was said and done, albeit in fairly unconventional ways.

Thanks to boffo returns on precious metals stocks, uranium, rare earths, antimony and the like, we logged smashing gains on some of our sector ETF exposure and many individual names. That all much more than made up for a few laggards/losers in other places.

That said, even in our big winners we've been taking some money off the table, mostly during Q4 and culminating in more cash register rining the beginning of this past week.

As our paid Members were instructed Monday morning, as well as in a new issue that went out Wednesday, we're redploying some of our profits now in both the list of names I indicated in that new issue (GREAT PM's stories that did not have such big moves yet in 2025) as well as in a few more new names I'm about to add.

Beyond all that, though--and as I have been warning of late--we're highly likely to start out 2026 resuming the delayed correction that started in November but was quickly short-circuited.

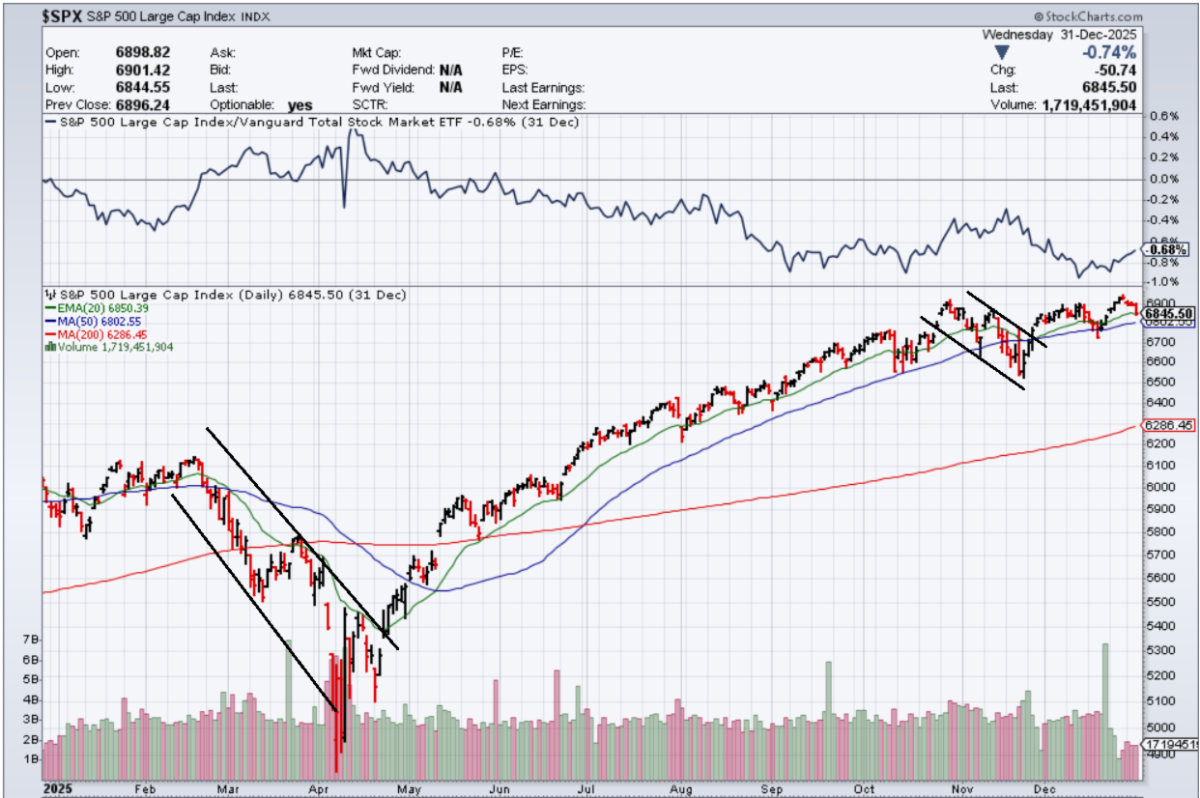

As you see above, there were only two periods of note in 2025 where stocks were of a mind to break their fairly steady "melt up" otherwise.

First, of course, following the early "honeymoon" encouraged by Trump 2.0 getting underway, stocks started a meaningful correction which accelerated into and through the president's so-called "Liberation Day" the beginning of April. But as things turned out, that was the low for the year.

Especially as President Trump engaged in multiple subsequent delays, contortions, retreats and the rest, markets came to fear real and threatened tariffs progressively less. And together with the gazillions of dollars of promised (and some actual!) "investments" Trump was announcing regularly, F.O.M.O. never relinquished its grip on the markets the rest of the year.

Except for in November...

Between growing economic/further trade worries and the continued bloodletting in global bond markets--paced by that "global margin call" in Japan Yours truly and others have been discussing--stocks were cracking anew. As I explained at the time, the technical damage was accumulating FAST.

But then N.Y. Fed President John Williams stepped in the Friday before Thanksgiving and--promising the December Fed rate cut that eventually DID come (though not without a lot of dissension)--the markets quickly righted themselves.

BUT what also came with that controversial rate cut was an unexpected--but apparently necessary--roll out of a fresh Q.E. program.

And with that as well came the removal of the prior lid on how much the Fed can intervene in overnight "REPO" and similar markets in their so-called "open market operations."

KEY!! -- It is the recent more frequent and larger Fed interventions to shore up markets that is a key thing to watch as we flip the calandar to 2026, for they tell a story far different than the one the president and his shills do in describing the greatest economy in the history of the solar system, etc.

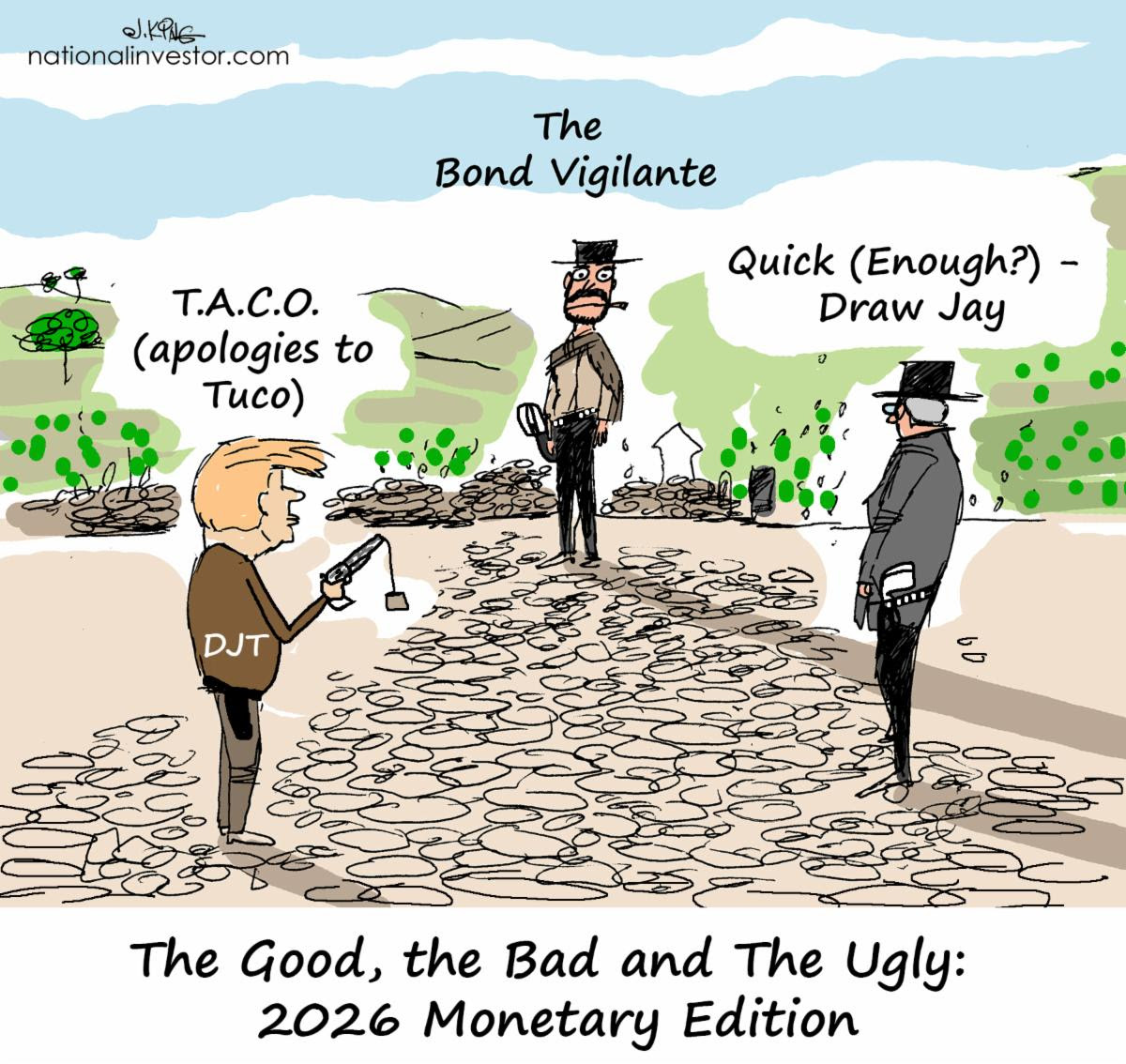

MAKE NO MISTAKE: The Fed in this new year ahead is going to be under even more pressure to keep all the various sky scrapers of cards from falling in the markets. Though they will have a nearly impossible task to make everyone happy when it comes to cutting interest rates (or not) alone, the money supply and repo market interventions will continue and increase.

And for his part, President Trump will be cajoling the Fed to act faster too, while he separately does everything he can to make sure the economy (read markets, mostly) continues to run suffieciently "hot" to not harm Republicans' prospects in November's mid-terms, all else being equal.

But it's likely going to be the Bond Market Vigilantes who have the most to say about the direction of the markets as 2026 gets underway.

They will continue to exert upward pressure on long-term interest rates pretty much no matter what the Fed and Trump say and do.

And especially when it sinks in a bit more that markets might not have quite the tail wind from rate cuts and the like as they have planned, all this is going to lead much more to a more volatile and two-way market for just about everything in 2026.

One last reminder: If you haven't already listened to my 2025 recap yet, you can do so RIGHT HERE or by clicking the below graphic.

That ties a lot together; and lays the groundwork for the next podcast or two (depending on if I split it into two, which I'm leaning toward!) that will lay out 2026's Theme and early market prognostications/

All the best,

Chris Temple

Editor/Publisher

From the desk of Chris Temple -- New Year's Day, 2026

Don't forget that you can follow my thoughts, focus and all pretty much daily ! ! !

* On Twitter, at https://twitter.com/

* On Facebook at https://www.facebook.com/

* On Linked In at https://www.linkedin.com/

* On my You Tube channel, at https://www.youtube.com/c/