Three Words Will Guide Markets in 2024: Supply…Supply…and SUPPLY!

By Chris Temple – Editor/Publisher

The National Investor

https://www.nationalinvestor.com/

Sunday a.m. -- Nov. 19, 2023

The present monetary tightening cycle which now seems to be nearing its end (as far as rate hikes by Fire Marshall Jay and his crew, anyhow; the Fed will reportedly continue trimming its balance sheet for the foreseeable future) has been responded to by the markets in two very disparate ways. First—through much of 2022—the general stock market sold off ferociously at times, with the S&P 500 ending the year down over 20% and the Nasdaq by nearly a third. And those weren’t even the worst levels of the year!

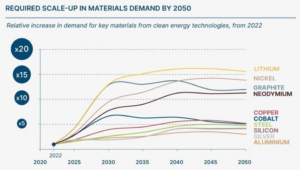

But in 2023—as rate hikes continued through the summer to their present/recent peaks—investors have been looking past this to the pined-for end of tightening; and more so to the presumed beginning of a renewed Fed easing cycle. As I have often said, in this the typical investor still can only envision a binary outcome here: if the Fed is about through tightening, then the next phase of things must be disinflation…an easing Fed…and once more what billionaire investor and former hedge fund manager Stan Druckenmiller quipped is an uber-friendly environment where, thanks to the Fed, investors feel like they are “surfing with a hurricane at their backs.” I have explained, though, why the outcome is going to be decidedly different. A plethora of things have changed in the world which will combine to galvanize “The Great Stagflation” going forward; and for many years to come. As I discussed recently with this publication’s editor Mike Fox, a “slow, dull ache” is going to be hanging around and worsening as far ahead as the eye can see. * And though the growth rate is set to slow somewhat as the E.V. industry (here also, hobbled by idiotic planning on the part of policy makers) deals with a variety of supply issues, the long-term story remains one where supplies of most of the raw materials needed for these are just not there.  And that outcome is one that most investors are NOT contemplating. Indeed, when you understand those three words in this missive’s title (just one, of course—SUPPLY, albeit in varying contexts) you’ll understand why as a matter of simple mathematics it’s all but impossible at this point to turn back the clock and go back to those happy days of disinflation, low interest rates, etc. (Check out The Set Up for the Long Painful Ache of Stagflation is Here to listen to a recording of this discussion.)

And that outcome is one that most investors are NOT contemplating. Indeed, when you understand those three words in this missive’s title (just one, of course—SUPPLY, albeit in varying contexts) you’ll understand why as a matter of simple mathematics it’s all but impossible at this point to turn back the clock and go back to those happy days of disinflation, low interest rates, etc. (Check out The Set Up for the Long Painful Ache of Stagflation is Here to listen to a recording of this discussion.)

The supply—or lack thereof—of commodities, credit, finished goods and much more will be a key driver of prices going forward. These dies have already been cast due to previous policy actions and more by both central banks and elected officials everywhere. We will be learning that the consequences of all these things will be hard to undo.

I’ll be discussing all these following elements and more in far greater detail in the weeks ahead. But for now, I want to give you a rundown of the key ways in which the economy, the inflation vs. deflation debate and markets are going to be primarily driven by supply…supply…and SUPPLY:

MONEY AND CREDIT GENERALLY; ECONOMIC IMPLICATIONS

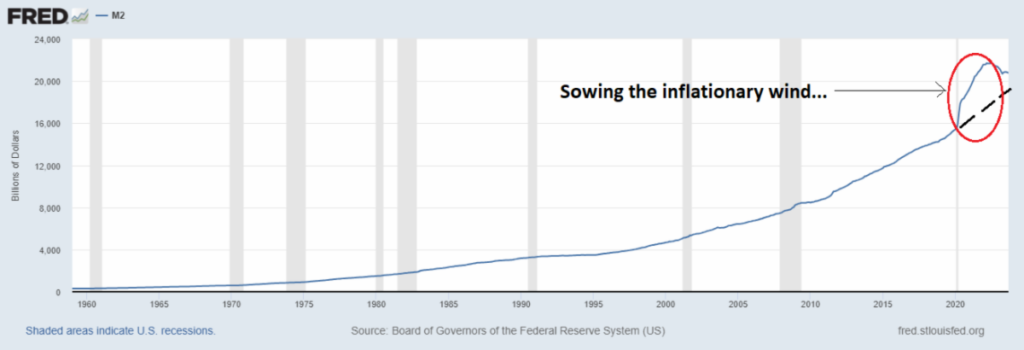

Some pundits have been pointing to the decline in the broad money supply (M-2) of recent months as their explanation as to why the decline in headline/core inflation will continue and be durable. Yet that view is premature at best (and in the end, I insist, just plain wrong) due in great part to what came before: the most outrageous and economically useless expansion of M2 in the first place.

As you have heard from Yours truly and others, from the outset of the COVID Plannedemic and onward for a while, some 30% of ALL the U.S. dollars ever created came into being thanks to the arsonist Jerome Powell. To date, now-Fire Marshall Jay’s ostensible “fire fighting” hasn’t even taken long-term M-2 growth back to its accelerating trend line as you see above; let alone below it. So in retrospect, it makes a bit more sense (notwithstanding the effects of this still to come) that markets and the broad economy have held up better than some of us thought would be the case to date.  We are beginning to see, though, some of these pressures becoming too great for parts of the economy to bear: most of all, so far, small businesses and average consumers. While recent months have seen record corporate bond issuance and a notable resumption of M&A activity (and even new offerings/IPO’s) on Wall Street, on Main Street the supply of new credit is already being crimped. Recent readings of the Federal Reserve’s “SLOOS” report (Senior Loans Officer Opinion Survey) indicate an evolving tightening in lending standards.

We are beginning to see, though, some of these pressures becoming too great for parts of the economy to bear: most of all, so far, small businesses and average consumers. While recent months have seen record corporate bond issuance and a notable resumption of M&A activity (and even new offerings/IPO’s) on Wall Street, on Main Street the supply of new credit is already being crimped. Recent readings of the Federal Reserve’s “SLOOS” report (Senior Loans Officer Opinion Survey) indicate an evolving tightening in lending standards.

This, in turn, is as all but the minority of consumers who are the best off financially are feeling more pressure. Delinquency rates for credit cards and sub-prime auto loans are at multi year highs. As reports from major retailers like Target and Walmart just told us, consumers are starting to pinch pennies even on groceries. Almost across the board—and even as it appears that travel will still be brisk this upcoming Christmas holiday season—retailers are dialing down expectations.

We already have even more a “Tale of Two Cities” than has been the case in our modern times, the “Haves” and Have-Nots” seeing their lots in life diverge more than ever. As the former are finally prompted, too, to be a bit more careful in their spending going forward, this will lead to some disinflation and even deflation. Indeed, I think that by next year’s post-Christmas clearance sales especially, retailers will really be pretty much giving stuff away.

Sadly, however, food, shelter, utilities, other energy and much more will continue to be rising in price due to all their supply constraints, even if oversupply of clothing, electronics and appliances brings their prices down.

BOND MARKETS AND MARKET INTEREST RATES SPECIFICALLY

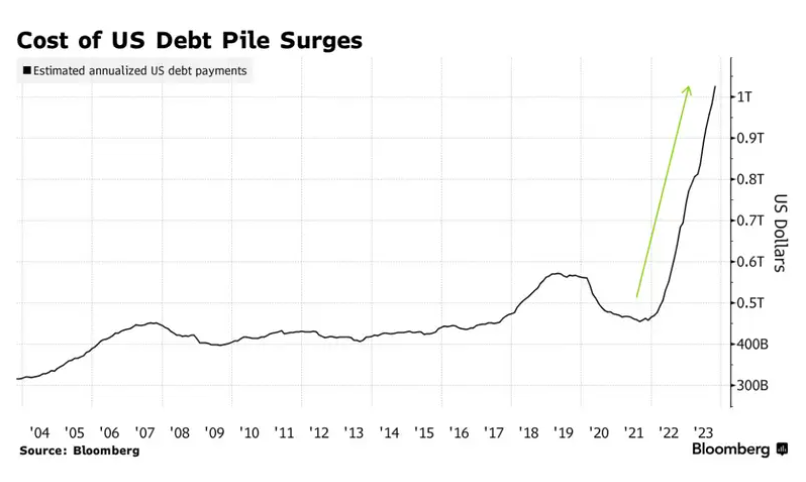

The biggest dynamic affecting markets and the economy in 2024 is going to be the behavior of market interest rates even if/when the point comes where the Fed (and the Treasury, as I discussed in a recent issue concerning their reported coming buyback scheme??) seeks to bring them down. As I discuss in a new issue of The National Investor out just before the U.S. Thanksgiving holiday, it is a very real possibility that next year we will see yet new highs for long-term Treasury yields even as the economy slows and the Fed has ended its tightening. Indeed—as I explain in that issue—the long end of the yield curve surging anew may well come about because the Fed has stopped tightening.  And this is because of how supply informs the outcome of credit costs. Already—thanks to both the Fed for being the chief enabler of ever-increasing government deficit spending and its own inflationary actions to goose markets—annualized interest costs on the U.S. national debt have now crossed $1 trillion. With one third or so of all the outstanding I.O.U.’s of Uncle Sam needing to be rolled over in the next 18 months, that interest cost will very nearly be doubling in the next two years.

And this is because of how supply informs the outcome of credit costs. Already—thanks to both the Fed for being the chief enabler of ever-increasing government deficit spending and its own inflationary actions to goose markets—annualized interest costs on the U.S. national debt have now crossed $1 trillion. With one third or so of all the outstanding I.O.U.’s of Uncle Sam needing to be rolled over in the next 18 months, that interest cost will very nearly be doubling in the next two years.

Especially if inflation is about through coming down—not to mention if it turns higher again due to the below factors—the resurrected Bond Market Vigilantes will REALLY make mincemeat out of the Treasury market (and that is why we probably will see at least an effort toward Yield Curve Control soon; a story for another day.)

And that would make matters even worse for everyone but the federal government needing to borrow rising amounts of money (talk about your “Tale of Two Cities!”) Even if a scheme does come about limiting what the Treasury will pay on its obligations, the cost to everyone—and I mean everyone—else of the remaining supply will really deal a blow to growth/economic activity. Nobody is ready for a world where Uncle Sam borrows money at 4% (take it, because you can’t leave it, if you are an insurer, pension fund or similar party) but the most credit-worthy corporations are paying two or three times that…and the rest of us perhaps more.

This is why the economic/market equation regrading interest rates and the like is changing now. It is no longer simply about consumer/producer inflation numbers. It is—as Mohamed El-Erian recently expertly and simply explained—about credit risk and supply; see https://www.bloomberg.com/

COMMODITIES WILL BE A KILLER

Just as investors do not understand how things have changed due to the burgeoning demand for new/rolled-over credit against a relatively more finite supply, neither do they yet “get” how the pricing of commodities going forward has drastically and irreversibly changed.

As we have already seen in spades with uranium—and have had occasional tastes of where oil, natural gas, lithium and other battery/industrial metals have been concerned—pricing for commodities going forward is no longer going to be driven by economic growth/expectations and the like. Instead, they will be driven by what, across the board, is a chronic and worsening lack of supply of most of them in ANY economic environment.

With others, I have been commenting/writing for a while now on the fact that surging commodity prices due to short supplies are going to be with us for many years to come; and Ill be discussing this in VERY great detail still in the weeks ahead via, chiefly, a series of Special Reports on precious metals, battery metals, “Old Energy” and the like. In short, due to disastrous (deliberately so in some cases) policy decisions and more, the world does not remotely have the production capacity for just about everything needed going forward: from day-to-day and ever-growing energy needs, to those of infrastructure, the now-somewhat stalling “energy transition” and more.

These dynamics are going to keep costs high and rising further even as other parts of the economy go into recession. And here again, neither consumers nor investors yet “get” the supply emergencies here, which will be one of the key reasons—the other “biggie” being the supply/cost of credit which will likewise remain MUCH higher than is presently anticipated—why The Great Stagflation will worsen…and be with us for a long time to come.

Don't forget that you can follow my thoughts, focus and all pretty much daily ! ! !

* On Twitter, at https://twitter.com/

* On Facebook at https://www.facebook.com/

* On Linked In at https://www.linkedin.com/

* On my You Tube channel, at https://www.youtube.com/c/