The Fed and your Money in 2020; Volcker, Revisited

By Chris Temple – Editor/Publisher

The National Investor

https://www.nationalinvestor.com/

Sunday, December 15, 2019 --

By the time the late President Ronald Reagan appointed him for a second term as Fed Chairman, Paul Volcker (the two of them above, of course, in the Oval Office) was already well into his "second act" at the helm of the central bank.

And it was that very different manifestation of Volcker's stewardship that set the table for today's no-holds-barred money printing and all the rest. Yet Volcker's "dovish" LAST five years or so of his tenure have been forgotten.

Except by a few of us. . .

As the eulogies and selective histories of the late Federal Reserve Chairman Paul Volcker continue to circulate, it falls to Yours truly to explain the real significance of Volcker's tenure.

I do not do so "to speak ill of the dead." This is about policy and our PRESENT challenges in a very-stretched fractional reserve system.

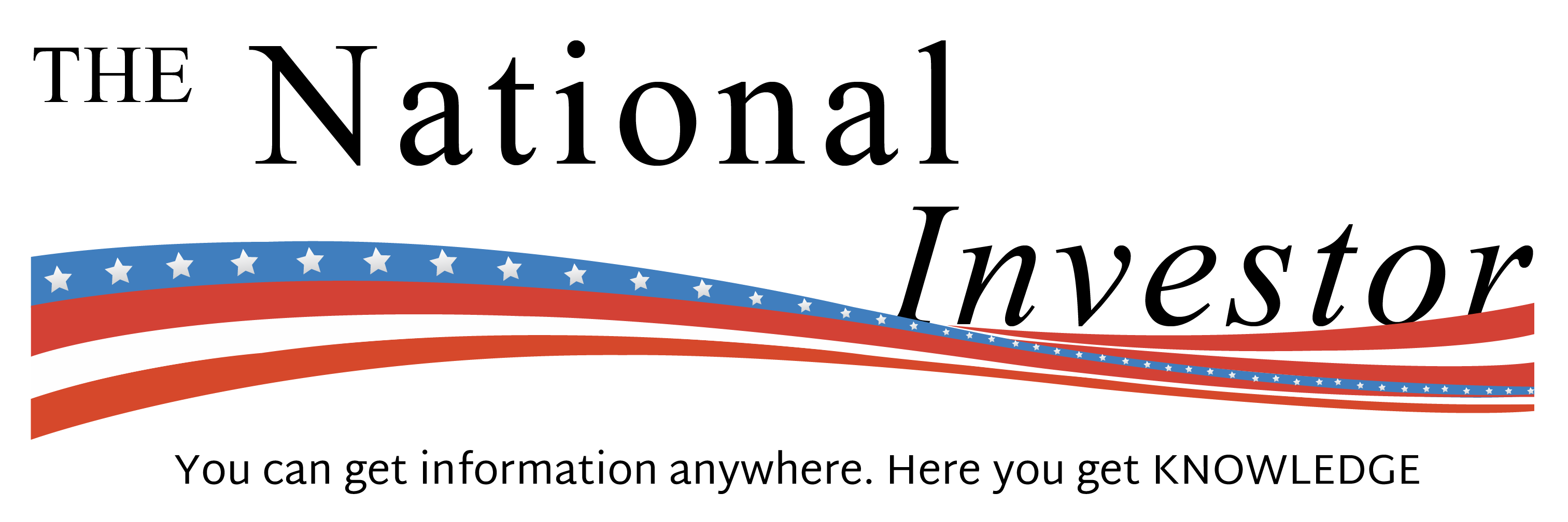

And it's especially necessary given the exact way in which the pattern of Jerome Powell's tenure as Fed Chair has mirrored Volcker's time on the job. . .

The Establishment version of Volcker is thus: Though it was tough medicine for the economy at the time--and arguably was a key part in rendering Jimmy Carter a one-term president--Volcker did what needed to be done to wring double-digit consumer price inflation out of the U.S. economy. Though such inflation has perked up a few times along the way since, thanks to Volcker it has never approached its late 70's-early 80's level (and probably never will.)

The "Rest of the Story": Volcker--aided by other factors where consumer price inflation was concerned, namely a change in U.S. industrial, trade and labor policies which kept consumer goods prices and wages in check--became the enabler of MUCH higher inflation than anything that had come before (not to mention the enabler of federal budget deficits in the 80's that were SEVERAL TIMES the level he and others complained of in the late 70's.)

He inaugurated the regimen we have had since: the transfer of FAR greater and ever-increasing levels of monetary inflation into asset prices.

Prior to Volcker, a healthy organic economy was the anchor of America's economic health, or occasional lack thereof. The stock market was a fairly direct reflection of said economy. Credit markets and banks functioned fairly well and properly priced in factors such as RISK, etc.

In Volcker's "second act," the Fed started its transition into the originator of economic health via the inflation of asset prices. And that is a regimen that has not only continued since, but has become ever more creative in the way the Fed now uses bubble-blowing as a means to "help" the economy; though at the expense of increasingly nasty BUSTS along the way.

Augmenting this discussion, I visited with the K.E. Report's Cory Fleck on this and what the Fed and other central banks face in 2020; along with the rest of us! Go RIGHT HERE to listen to this VERY "meaty" 15-minute discussion, which features a history of Volcker and the Volcker-Powell parallels.

While you're here, though, here are just a few quick key points where the similar Volcker/Powell tenures are concerned; and what that is going to mean in 2020.

Keeping things fairly short and sweet, "Jay" Powell took the helm of the Fed at the beginning of 2018 every bit as much resolved to be the "hawk" Volcker ostensibly was when the latter was given the Fed's reins by President Carter in the fall of 2019.

But by last December as we all know, Powell was forced to surrender. That first 11 months or so of his term was humorously and pictorially chronicled by me (with a KEY assist to my boffo cartoonist, Jerry King, who came up with the pictures for my words) RIGHT HERE, from my web site.

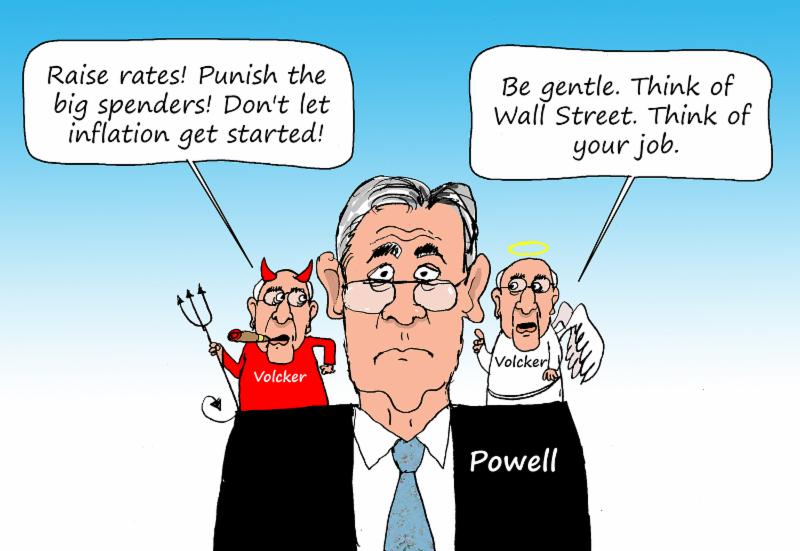

Now, Powell is in his second act as Fed Chair; that of a dove, money printer (a fairly desperate one, at that, all of a sudden) and enabler of MORE record federal debts, etc.

BUT there is one BIG ominous difference between Powell's lot now and that of Volcker from late 1982 or so onward, even if the pattern is the same.

And that is, Volcker had the relative luxury of inaugurating the era of asset inflation/bubble economics with a full "tool kit" and with LOTS of rate cuts at his disposal, starting from such a high level.

Powell, on the other hand, has little "ammo" left.

Further, and also unlike Volcker (though Volcker also inaugurated during his watch the regimen, too, of getting the rest of the world's central banks to follow the Fed's "activist" lead) Powell today has to worry about pretty much the whole world's health; at least, of its markets and credit structures.

And among other things, that means we'll be seeing some unprecedented further--and sometimes desperate--moves by Powell to keep these enormous skyscrapers of cards I referred to in my discussion with Cory from IMPLODING.

The year ahead promises to be a rollicking one, for sure. If you thought the 2016 election campaign was a toxic, dopey (at times) spectacle, you ain't seen nothing yet!

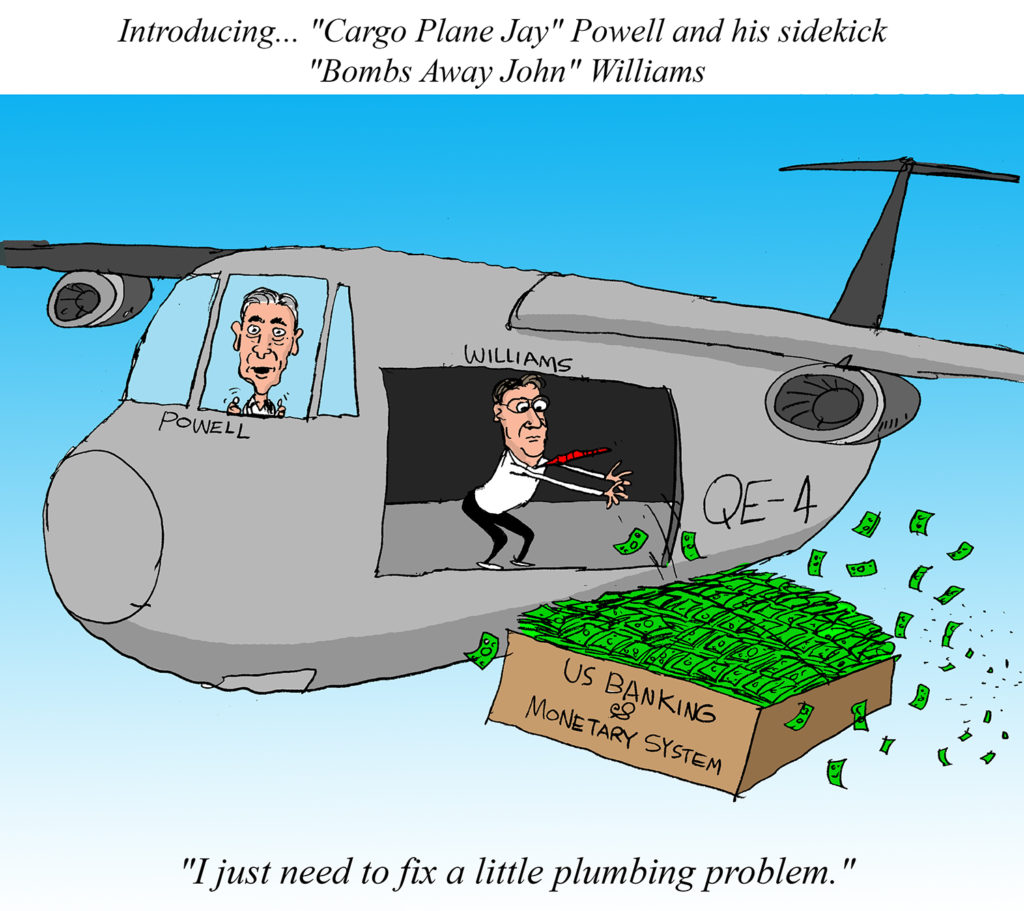

And as 2020 approaches, we've arguably NEVER been faced with the confluence of GROWING DEFLATION RISKS in the world on the one hand, with a central bank, under Powell, throwing just about everything inflationary at this looming disaster he can (the kitchen sink and other appurtenances will follow!)

As I pointed out on the recording, Powell's desperation was newly manifested just this past week, when the Fed announced a further MASSIVE "Drano" injection as I've termed it into the repo market.

And as I'll be discussing separately in the very near future, Europe's banking system has its own just-discovered $9 trillion repo hole.

And that is on top of the evolving messes and growing defaults in China and Hong Kong of late!

All this of course means that--notably, armed with the correct definitions and understandings of these terms in the first place, such as I have long explained in my signature essay, Understanding the Game--investors and consumers alike are going to be squeezed by competing inflationary and deflationary forces in 2020 as never before.

Knowing how to anticipate, identify and maneuver between them will be CRITICAL to your portfolio's health!

So stay tuned. . .

And BTW, for those able to handle a considerably more detailed and telling look at the Volcker legacy and record, I suggest THIS ARTICLE I just ran across, by F. William Engdahl.

As always, I welcome your comments and questions. Drop me a line at chris@nationalinvestor.com.

AND DON'T FORGET -- Before you know it the Holiday Season will be gone (and with it, your ability NOW to become a Member or extend your Membership at my "2 for 1" rate!!)

Simply VISIT ME HERE

Don't forget that you can follow my thoughts, focus and all pretty much daily ! ! !

* On Twitter, at https://twitter.com/

* On Facebook at https://www.facebook.com/

* On Linked In at https://www.linkedin.com/

* On my You Tube channel, at https://www.youtube.com/c/