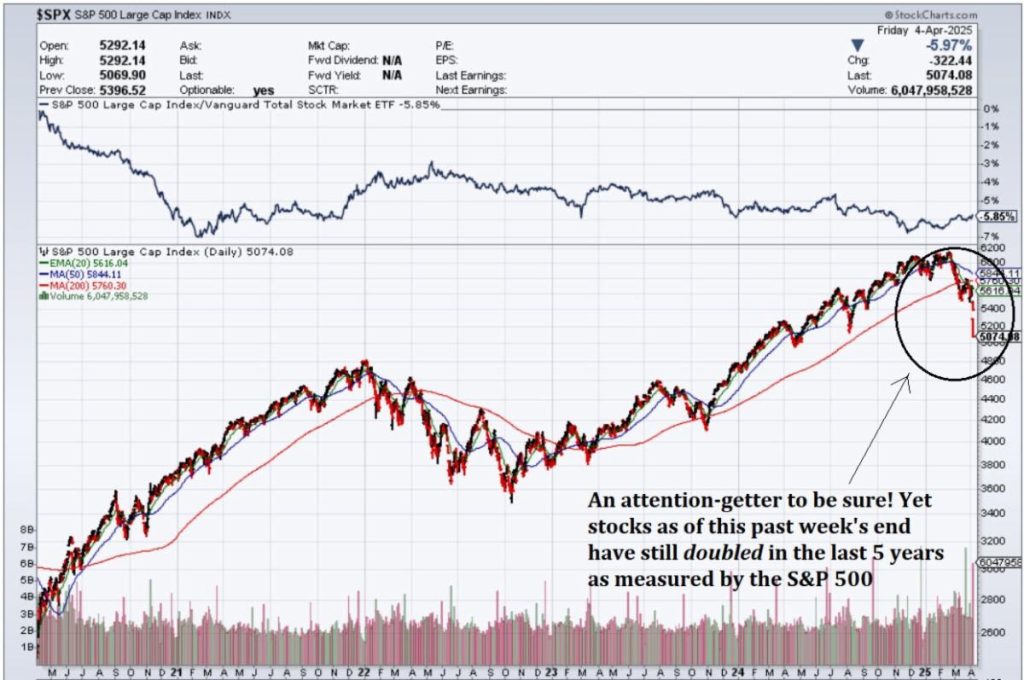

Greetings Investors! I’m winding down my Midyear macro / sector discussions. Previously, for those who missed them, we’ve had: –> Enterprise Group (TSE-E; OTCQB-ETOLF) President Des O’Kell and a look at Canada’s energy sector, as a MAJOR milestone for that…