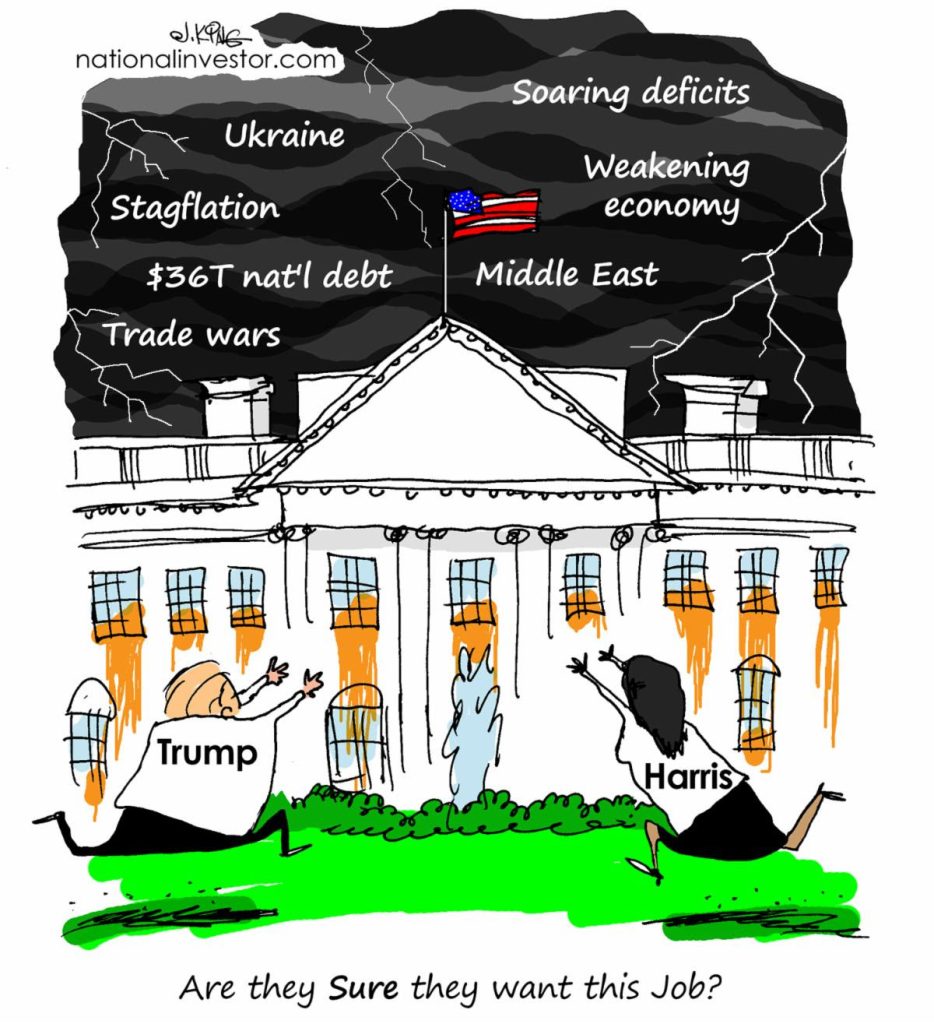

Greetings Investors! Putting together an especially meaty podcast (LISTEN HERE) late this past week, The Prospector News’ Mike Fox and I mused over why either Donald Trump or Kamala Harris would even want the job of being president the next…

Greetings Investors! Putting together an especially meaty podcast (LISTEN HERE) late this past week, The Prospector News’ Mike Fox and I mused over why either Donald Trump or Kamala Harris would even want the job of being president the next…

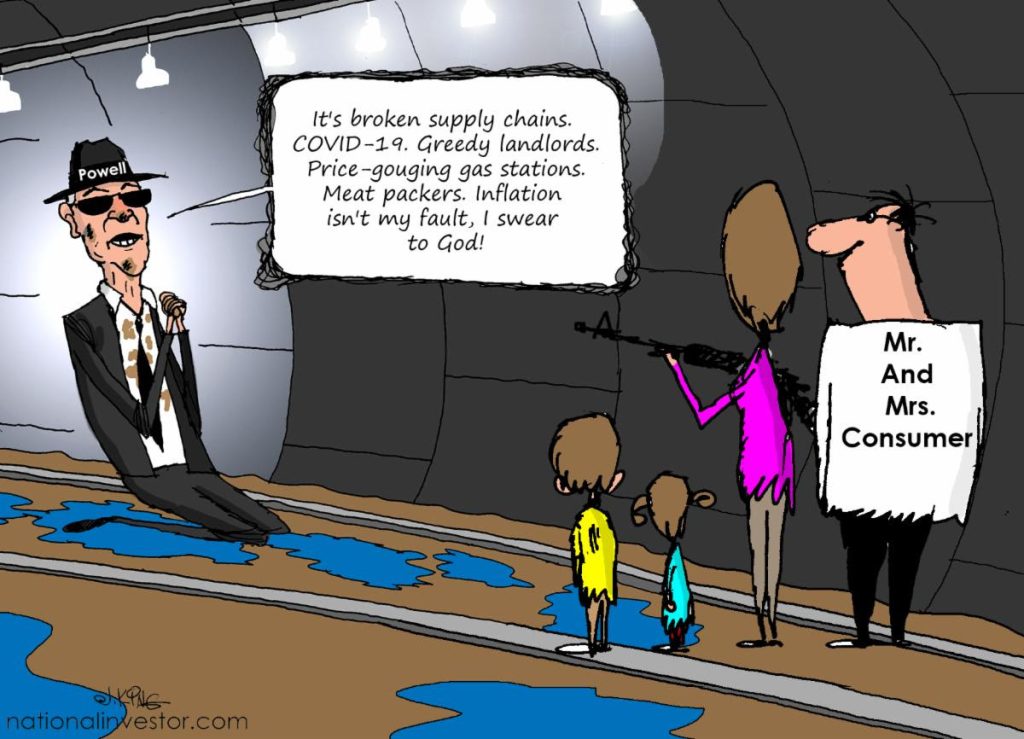

Good morning Investors! Fed Chairman Jerome Powell and his merry band somewhat surprised markets following their most recent policy-setting meeting on September 18, cutting the official short-term (federal funds) rate by 50 basis points rather than 25. Some took this…

Good evening Investors! Just following the late August Kansas City Fed-hosted annual summer picnic in Jackson, Wyoming, I recapped Fed Chair “Joliet Jake” Powell’s evolving messaging and what it portends with The Prospector News’ Michael Fox. In THAT DISCUSSION, I…

Today, we mark summer’s unofficial end. I guess I am getting older, as this one flew by faster than any summer of my life! We’ll be up north a bit longer still, but looking past that, I’ll be weaving my…

Greetings investors! The seemingly unstoppable rally on Wall Street (thin though it’s been for most of its run, as I have been discussing) has been fed by ever-growing inflows into large-cap and Mag 7-related funds especially. I’m going to help…

This coming week we’ll be gearing up in a bit more earnest to navigate the back half of 2024, now that the early Summer Canada Day/Independence Day holidays are past. It’s time for our Mid-year Market Wrap Up! Between the…

If it’s been a while since you checked in on Energy Fuels (NYSE-UUUU; TSE-EFR) you are in for one hell of a treat! Already one of my core uranium-related companies (along with, most notably, Uranium Energy Corp. (NYSE-UEC), Energy Fuels…

Again this past week with our Konni Harrison, I picked up somewhat where we’d left off in the prior week’s discussion I sent you last Sunday; that on “The Great Stagflation.” This time, we discuss the changing of the guard…

Late this past week with our Konni Harrison, I gave AN UPDATE on the renewed dynamics of The Great Stagflation which–among other things–have led to: —> New 2024 highs for both inflation and interest rates (and going higher still in…

If you are: * A current or prospective investor in E.V.-related companies of most any kind… * In management of such companies in any way… * A concerned consumer and citizen who NEEDS to know just what a MESS policy…

Three Words Will Guide Markets in 2024: Supply…Supply…and SUPPLY! By Chris Temple – Editor/Publisher The National Investor https://www.nationalinvestor.com/ chris@nationalinvestor.com Sunday a.m. — Nov. 19, 2023 The present monetary tightening cycle which now seems to be nearing its end (as far…

By Chris Temple – Editor/Publisher The National Investor https://www.nationalinvestor.com/ chris@nationalinvestor.com (Sunday — December 17, 2023) Since very belatedly starting to mop up the historically extreme oceans of new money/credit that he first unleashed from late 2019-early 2022, Fed Chair…

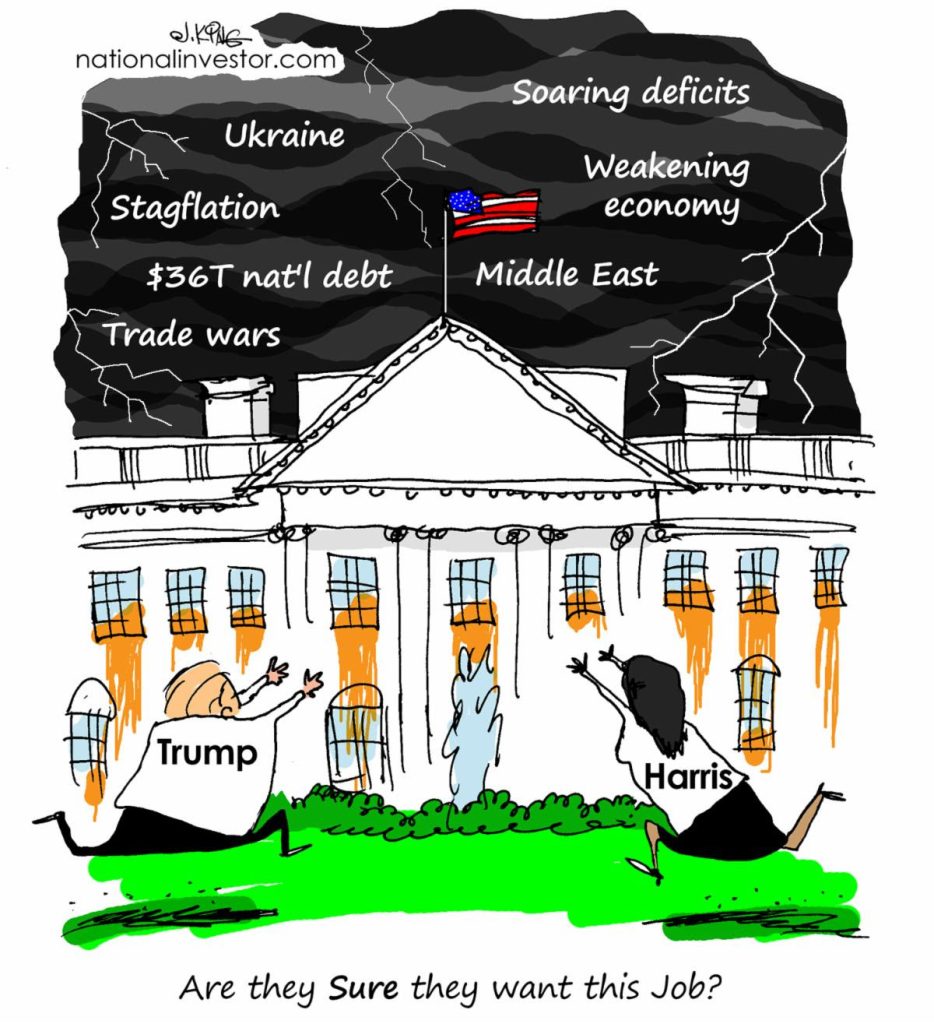

COMMENTARY – May 14, 2022 In his Clintonesque “I feel your pain” message to America on the inflation crisis this past week, President Biden—among other things—insisted that he’s going to compel America’s energy sector to produce more to help alleviate…

By Chris Temple – Editor/Publisher The National Investor https://www.nationalinvestor.com/ chris@nationalinvestor.com Commentary and Analysis — Saturday, Feb. 12, 2022 We all know that–quite soon–the Federal Reserve at long, belated last is going to begin at least trying to undo some of…

For those who missed the live version this past Wednesday, Jan. 12, here is the complete video/slide presentation… This was incredibly well-received by the hundreds of people who signed up…don’t miss out yourself now that you can watch this at…

By Chris Temple – Editor/Publisher The National Investor https://www.nationalinvestor.com/ chris@nationalinvestor.com At the end of January’s first week, I was invited to join my friend and colleague Trevor Hall on the first “long form” discussion of 2022 on his Mining Stock Daily podcast.…

China and the New World DISORDER By Chris Temple – Editor/Publisher The National Investor Tune in to Chris Temple of the National Investor as he discusses the situation with China and the New World DISORDER following their advancement on the…

By Chris Temple – Editor/Publisher The National Investor https://www.nationalinvestor.com/ chris@nationalinvestor.com (From the third regular issue of The National Investor for September, 2021) Investors just as much as politicians too often get caught up in often-stale, simplistic narratives on a subject–in…

Building Critical Minerals Infrastructures: Opportunities and Roadblocks By Chris Temple – Editor/Publisher The National Investor https://www.nationalinvestor.com/ chris@nationalinvestor.com The week of March 8 saw ambitious plans laid out in both the U.S. and Canada for building the Green Economies of the…

The “Reddit Revolution” — are all those Peasants with Pitchforks buying GameStop, et al to fight hedge funds the whole story? By Chris Temple – Editor/Publisher The National Investor https://www.nationalinvestor.com/ chris@nationalinvestor.com As usual, I was starting off the 2nd regular…

POWER-PACKED Discussion: Eliminating “Trumpism” and The Biden Administration ahead By Chris Temple – Editor/Publisher The National Investor https://www.nationalinvestor.com/ chris@nationalinvestor.com Posted Thursday morning, January 7, 2021 Yesterday (Wednesday) — in between keeping our eyes on the crazy scenes unfolding in our…

OILMAGEDDON–And the Consequences of American Hubris By Chris Temple – Editor/Publisher The National Investor https://www.nationalinvestor.com/ chris@nationalinvestor.com (from the March 31, 2020 Issue) GUARANTEED to piss off Trump sycophants and those with T.D.S. (Trump Derangement Syndrome) alike, here’s a BADLY needed…

The Fed’s Next Act: But Judy Shelton Might not be Around for It By Chris Temple – Editor/Publisher The National Investor https://www.nationalinvestor.com/ chris@nationalinvestor.com Congress can do no more than play confused, partisan politics with the central bank—and a new nominee—at…

The Fed and your Money in 2020; Volcker, Revisited By Chris Temple – Editor/Publisher The National Investor https://www.nationalinvestor.com/ chris@nationalinvestor.com Sunday, December 15, 2019 — By the time the late President Ronald Reagan appointed him for a second term as Fed Chairman,…

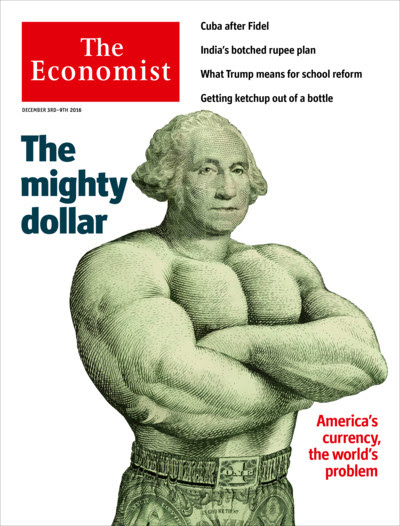

“The World Turned Upside Down” By Chris Temple – Editor/Publisher The National Investor https://www.nationalinvestor.com/ chris@nationalinvestor.com (From the July 29, 2019 issue) Markets seem both oblivious to and unprepared for a MAJOR change that’s looming in the world: the end of…

The Modern Monetary Theory “Debate” By Chris Temple – Editor/Publisher The National Investor https://www.nationalinvestor.com/ chris@nationalinvestor.com (From the April 15, 2019 Issue) I put “Debate” in quotes above since what you are hearing on this suddenly-HOT issue is, for the most…

A year in the life of Fed Chair Jerome Powell By Chris Temple – Editor/Publisher The National Investor https://www.nationalinvestor.com/ chris@nationalinvestor.com (Posted Feb. 6, 2019) With all the attention on the president’s State of the Union address last night and myriad…

C.R.E. Preview — My conversation with Ambassador Thomas Graham, Jr. By Chris Temple – Editor/Publisher The National Investor https://www.nationalinvestor.com/ chris@nationalinvestor.com I’m privileged in this discussion here to visit with Ambassador Thomas Graham, Jr. who, over the better part of four…

The “Death of the Dollar” Nonsense — Here’s the latest By Chris Temple – Editor/Publisher The National Investor https://www.nationalinvestor.com/ chris@nationalinvestor.com (Posted Aug. 18, 2018) — From most of the usual suspects, there have again been “sensational” and “SHOCKING” revelations recently…

Gold Manipulation – A History Lesson By Chris Temple – Editor/Publisher The National Investor https://www.nationalinvestor.com/ chris@nationalinvestor.com (From the Feb. 20, 2018 Issue) From time to time I clarify my own position–and provide some common sense and history–to address a well-flogged…

Now THIS was “Gold Suppression!” By Chris Temple – Editor/Publisher The National Investor https://www.nationalinvestor.com/ chris@nationalinvestor.com I regularly call out the carnival barker types among the “Pied Pipers of the Gold Bug Echo Chamber” for putting out utter nonsense at times…

An Infrastructure Bill’s importance to “The Game” By Chris Temple – Editor/Publisher The National Investor https://www.nationalinvestor.com/ chris@nationalinvestor.com (Posted August 16) This week President Trump announced some unilateral measures he was taking on the regulatory/administrative front to try and remove some…

THIS is the Revived Roman Empire!? By Chris Temple – Editor/Publisher The National Investor https://www.nationalinvestor.com/ chris@nationalinvestor.com (COMMENTARY and News from the Sept. 5, 2016 issue) I vividly remember when — in the late 1990’s, as a growing European Union was…

EXPOSED: The usual Hucksters and their warnings (again!) of a new “world currency.” By Chris Temple – Editor/Publisher The National Investor https://www.nationalinvestor.com/ chris@nationalinvestor.com (Adapted from the first August, 2016 issue) On schedule, those “experts” who specialize in taking a grain…

Building an Economic Lifeboat By Chris Temple – Editor/Publisher The National Investor https://www.nationalinvestor.com/ chris@nationalinvestor.com Here’s my two-part interview of my old friend…and hero…and (among other things) creator of the Ithaca HOURS community currency, Paul Glover. (For more on Paul’s activities,…

Each year at Christmas for some time now, I have shared the accompanying commentary by the late Mennonite theologian, John Howard Yoder. To me it indeed does reflect the truly revolutionary, epochal event of over two millennia ago, when our…

(NOTE: New/returning subscribers will now receive the NEW/EXPANDED VERSION!!) Though nearly a decade old, Chris’ “signature presentation” here remains the best primer on the nature of our markets you will read ANYWHERE. Once you have read this, you will know…

When energy giant Enron imploded in scandal and financial ruin, too many described it as a tale of political cronyism, greed and whatnot. The truth was deeper than that: Enron collapsed because it had turned itself into the poster child…

Once upon a time in America, there was a thriving middle class; citizens able to enjoy “The American Dream” because they had good, stable jobs that paid a living wage. One of the great advocates of “A Square Deal” for…

It’s been nearly 15 years since this key Depression-era legislation was repealed by a Republican Congress and Democrat president. The reasons why the banks were pushing for Glass-Steagall to be deep-sixed became evident with the monstrous mortgage and derivatives boom–and BUST–of…

(NOTE: Chris will be updating the Ithaca HOURS story and adding a LOT to it in his upcoming Special Report entitled “Building an Economic Lifeboat.”) Years ago, Chris wrote of a wonderful new–and successful–experiment to create “an economy within an…